Peter Stewart, strategic account manager and associate director at Waverton, considers what is meant by the Quality factor and why they are important twine investing late in the economic cycle and during recession.

Beyond the more obvious categorisations such as country or industry, it can be possible to group equities by various factors or characteristics. The most well-known of these factors are Value and Growth. MSCI – a market leading data provider – produces a large number of different factors, of which seven have the widest use: Minimum Volatility, Yield, Quality, Momentum, Value, Size, and Growth.

At Waverton we look to invest through the cycle, taking a multi-year view and not trying to time the market. We try to find companies that can participate during upward moves in the market and provide protection during periods of market weakness.

We have a well-established stock selection process, where we look at a global pool of companies which we then adjust for liquidity, only considering companies that have a sufficient volume of trading to mitigate our risk.

We then ensure that the companies in which we invest fulfil the four criteria that we look for: durability, opportunity, alignment and valuation. Ultimately this means companies that can produce a reliable source of free cash flow for the foreseeable future, which in turn will, we believe, translate into strong performance.

Although we are not factor investors, the process that we follow tends to produce a portfolio that aligns reasonably well with the Quality factor. MSCI defines Quality as “a composite of profitability, low leverage, stable earnings, quality of earnings and limited balance-sheet expansion” [1] – broadly this ties in with the traits that we seek.

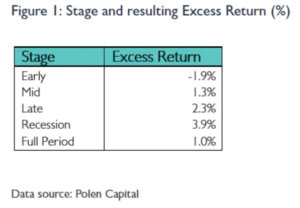

There are various studies, such as those from MSCI [2] and Polen Capital [3] (Figure 1) and Waverton’s own in house analysis, that show that through the cycle, Quality stocks tend to outperform the index. This is one reason for our interest in stocks with these kinds of characteristics.

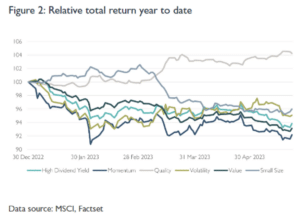

Furthermore, and particularly pertinently in the current economic climate, much of the outperformance of Quality stocks comes late in the economic cycle and during recession, as work such as that from FTSE Russell [4] shows. We have seen this outperformance in the data since the beginning of 2023 – the Quality index has been outperforming the index, as shown in Figure 2 below. Pleasingly, Waverton’s equity portfolios have also been performing well.

All factors are not mutually exclusive, though some are – a company can be in both the Momentum and Large Cap categories for example. Growth and Value though can be seen as sitting on a spectrum, one cannot be both at the same time. At Waverton we have our own propriety framework whereby we are able to classify equities into one of five distinct buckets on the Value-Growth Spectrum: High Growth, Growth, Core, Value, Deep Value, whereby Core is the classification for those that do not fall into one of the other classes.

As mentioned before, within the companies that we select, there tends to be a Quality bias, by virtue of our stock picking process. With our own Growth-Value framework we are able to group our holdings further according to their underlying characteristics, this is useful when constructing a portfolio since the different buckets tend to react differently under different macroeconomic conditions.

It is not realistic for any one stock-picking style to be permanently in vogue, but we believe that our approach is well suited for our mandate – to outperform through the cycle.

References:

1. Quality in Times of Crisis – MSCI

2. Factors – Elements of Performance – MSCI

3. Qualitys-Performance-Across-the-Business-Cycle.pdf (polencapital.com)

4. Time to Target a Quality Exposure in Small Cap Equities? | FTSE Russell