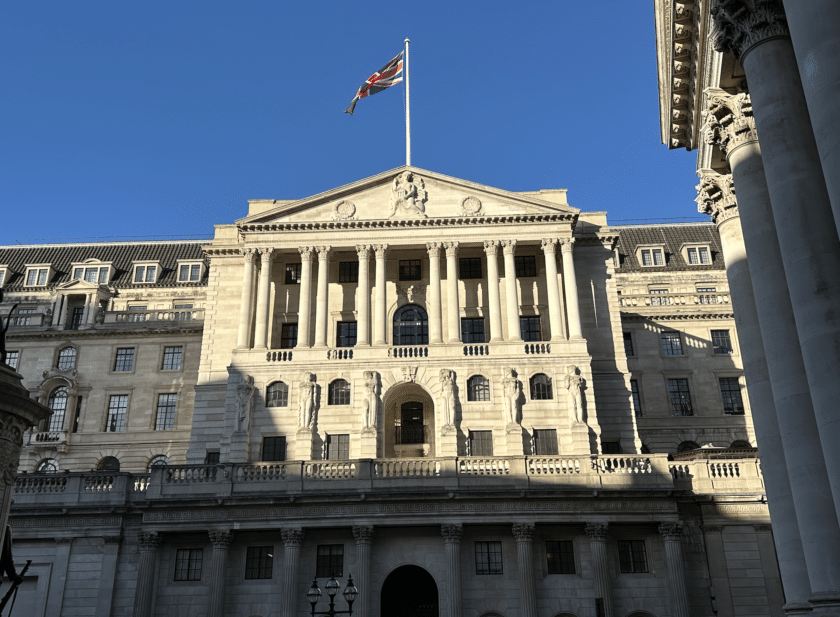

The Bank of England held the interest rate at 5.25% in May but two members of the Monetary Policy Committee voted for a cut, which has increased speculation that a June rate reduction is on the cards, in turn generating market optimism.

Abhi Chatterjee, chief investment strategist at Dynamic Planner said the split in the vote with two members voting in favour of rate cuts was a surprise.

“This will no doubt fuel expectations of rate cuts in the upcoming meetings, driving yields down and creating exuberant equity markets – to further bolster the “feel good” factor in the economy,” he said. But added: “However, it would be prudent on the part of the Bank of England to carefully consider the next steps, as the conditions which caused inflation to be stickier than expected have not changed. The agglomerated effects of the macro environment could weigh heavily on the interest rate decisions. While it is desirable to have lower interest rates to fuel growth, the unintended consequences of a hasty decision could possibly make us careful as to what we wish for.”

Ed Monk, associate director at Fidelity International, said the doubling of the doves “is a gentle signal that things are still heading in the right direction – albeit more slowly than markets and households might want. The last leg of problem inflation looks like it will be the hardest to shift and the majority view at the Bank is clearly still that inflationary pressures need to fall back further.

But Monk added: “In reminding that that policy must ‘remain restrictive for sufficiently long’ the Bank does not appear to be signalling an imminent rate cut – June now looks optimistically early. There will have to be a shift in language as the summer progresses if the first rate cut is to come through before the Autumn.

“Slower cuts to interest rates could be a signal of a more robust economy and lead to more sustainable and broad-based returns from investment assets.”

Susannah Streeter, head of money and markets, Hargreaves Lansdown said while the forecast for a lacklustre economy, and prospects of higher unemployment ahead, “would ordinarily not give way to celebration”, it was being read as good news, “because it means an interest rate cut in the summer is increasingly likely”.

She noted “a fresh run of enthusiasm among investors, helping the FTSE 100 climb sharply and extend its record run” and said she expects the Bank of England “to move much more quickly than the Fed in cutting rates, given the changing sentiment at the Bank.”

But she added there was still room for caution. “Even though inflation is soon expected to reach the target of 2%, the Bank is expecting that it will creep back up again to around 2.5% later this year. Given that the Bank says it wants to ensure that inflation returns ‘sustainably’ to target, the implication here is that a June rate cut may still be too close for comfort for some policymakers. Upcoming economic data will be scrutinised closely in the weeks to come, and certainly a June rate cut can’t now be ruled out, but August remains more probable.”

It is also likely the UK will not closely follow the Federal Reserve’s decision making, suggested William Marshall, Chief Investment Officer, Hymans Robertson Investment Services. He said: “The setbacks that the US has experienced with inflation data over the last few months has pushed back the Federal Reserve from cutting soon. There is conjecture that this will delay other central banks like the BoE and ECB, who wish to avoid weaker currencies raising import prices. However, the UK economy is far weaker than the US and members of the MPC have tried to give the impression that they move fully independently of Fed policy. A slower Fed may mean the BoE will move more carefully but it shouldn’t stop the cuts altogether.”

Meanwhile, XPS Pensions Group partner Danny Vassiliades warned that with signals towards lower rates, pension schemes “should review the suitability of their funding and investment strategies to ensure that any future, unexpected rates cuts don’t adversely impact the current record funding levels that have seen around half of all DB pension schemes being fully buy-out funded.”