In a three part article covering what you need to know about top slicing relief, the M&G Wealth Technical Team look first at what top slicing is and how it works. Articles 2 & 3, published later this week, will cover top slicing calculations and FA 2020 top slicing measures.

Why use top slicing relief

In our articles UK Investment Bonds: taxation facts and Taxation of Offshore Policies article we explained that chargeable event gains are treated as forming the highest part of total income in a top slicing relief calculation. The relief can assist in reducing the rate of tax charged on bond gains by applying a spreading mechanism.

With regard to basic/higher rate taxpayers, the implications of the Scottish Rate of Income Tax (SRIT) need to be addressed for Scottish taxpayers. SRIT applies to non-savings and non-dividend income with the personal allowance and thresholds and taxes on savings and dividends remaining a UK ‘reserved’ matter. The higher rate threshold for Scottish taxpayers is below the threshold in the rest of the UK. Nevertheless, given that the Scottish Parliament can only set the rates and the limits for non-savings and non-dividend income, then for savings, dividends and capital gains, it is necessary to ignore the Scottish threshold and refer to the UK limit instead.

Top slicing relief is generally available where the taxpayer would be liable to tax at a lower rate were it not for the inclusion of the chargeable event gain in their income for the year. When the chargeable event gain does not move a taxpayer into a higher tax rate, there may be still be some top slicing relief available due to the effect of the personal savings allowance nil rate and the starting rate for savings.

The Personal Savings Allowance and the Starting Rate for Savings

The starting rate for savings and the personal savings allowance nil rate should be taken into account when calculating top slicing relief, where applicable.

The starting rate for savings is available to those taxpayers with total non-savings income of less than their personal allowance plus £5,000. If taxable earned and other non-savings, non-dividend income is above £17,570 for 2022/23 (or £20,170 for those eligible for the blind person’s allowance), the starting rate for savings will not apply to the taxable savings income.

The personal savings allowance nil rate band is applied to the first £1000 of savings income for basic rate taxpayers, and the first £500 for higher rate taxpayers.

The personal savings allowance and the starting rate for savings are nil rate tax bands and are not therefore ‘allowances’. Despite that, in IPTM3820 HMRC state

“These allowances are not adjusted when calculating the notional tax due on the ‘sliced gain’.”

Reduced Personal Allowances

For an individual whose adjusted net income exceeds £100,000, the amount of the personal allowance available to them in that tax year is reduced accordingly in accordance with ITA07/PT3/CH2/S35(2).

In the Budget of 11 March 2020, measures were announced allowing the personal allowance to be reinstated within the calculation for top slicing relief where it has been reduced by reason of including a gain in the individual’s income for the year. For this purpose, the personal allowance is to be calculated by reference to the taxpayer’s other income and the relevant slice.

The previous position was that where the personal allowance had been reduced, it was that reduced figure which was used in the top slicing calculation.

The measures were included in Finance Bill 2020. The Bill received Royal Assent on 22 July 2020 and became the Finance Act 2020.

How spreading works

The key to a top slicing calculation is to divide the gain by the number of complete years. HMRC use ‘N’ to denote the number of complete years. ‘N’ which can never be less than one is calculated as follows:

Note that an ‘excess event’ arises on a part surrender or a part assignment.

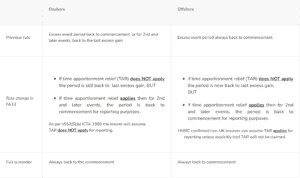

The Finance Act 2013 (FA 13) brought in updates to the chargeable events legislation in respect of time apportionment relief (TAR) to include onshore policies as well as offshore. Essentially, TAR was extended to policies issued by UK insurers on or after 6 April 2013 and to existing policies issued by UK insurers which are modified on or after that date. FA 2013 amended Section 536 (2) ITTOIA 2005 which is a section dealing with top slicing rules. Under TAR, the chargeable gain may be reduced for tax purposes if the beneficial owner was not UK resident throughout the policy period. TAR applies by virtue of S528 ITTOIA 2005.

The effect of these changes on calculation events for UK resident individuals holding offshore policies who have been UK resident throughout is therefore as follows:

Pre 06/04/13 policies

Number of top slicing years equals number of years since inception.

Policies made on or after 06/04/13 (or earlier policies varied etc. on or after that date)

Number of top slicing years equals number of years since previous event.

For those UK residents who have not been UK resident throughout such that TAR applies, then the number of years used remains the period back to commencement but that figure will be reduced to reflect periods of overseas residence.

(See article for 2 for Top slicing relief calculation).