Six workplace pension providers have been awarded a gold rating for financial wellness in Benefit Guru’s annual Financial Wellness Ratings.

The ratings, designed to help benefits consultants, employers and advisers review products that improve member and employee outcomes and financial resilience, included Financial Wellness without Open Finance and Financial Wellness with Open Finance.

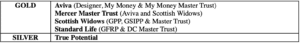

Aviva, Fidelity, Hargreaves Lansdown, Scottish Widows and Standard Life all achieved an overall Financial Wellness without Open Finance gold rating for a number of their propositions and in a number of sub categories such as personalised financial education and addressing vulnerable customers.

Aegon, Cushon, Legal & General, the Mercer Master Trust, Royal London and True Potential received a silver rating.

Meanwhile, Aviva, Mercer, Scottish Widows and Standard Life all achieved gold in the Financial Wellness with Open Finance category. True Potential was recognised with a silver rating.

Benefits Guru said financial wellness remains of “growing importance” to the workplace market due to the financial stress experienced since the onset of Covid-19, with pension providers innovating and enhancing their financial wellness propositions to incorporate tools, information and services.

Jason Green, head of workplace research at Benefits Guru, said: “Year on year, it’s exciting to see providers adapt and grow their proposition with innovative and market leading initiatives that help members improve their financial lives. Financial wellness and improving member outcomes are at the forefront for all workplace pension providers. They are increasingly well-placed to help savers build a financial resilience market, helping consumers be more comfortable with their finances.

“Financial resilience, security and stability remain a key concern for consumers. Workplace pension providers are shaking off their image as a traditional long-term saving plan which can be only accessed at retirement by building tools and services which are relevant today to help plan for tomorrow.”

Roy McLoughlin, director, strategic partners at Cavendish Ware, commented: “The Financial Wellness capabilities of pension providers should be a major consideration for all advisers when recommending a workplace pension scheme. Helping members better manage their finances today, to enable better savings for the future, should be seen as part of the advice process.

“For advisers to have access to such readily available information which focuses on the ever-changing Financial Wellness capabilities that are on offer from workplace pension providers is extremely valuable.”

Financial Wellness without Open Finance ratings

Financial Wellness with Open Finance Ratings