For her latest article for Professional Paraplanner, examining funds or managers approaching their three-year track record, Juliet Schooling Latter, research director, FundCalibre, looks at the abrdn Global Smaller Companies fund.

It was the great Chinese philosopher Confucius who said, “our greatest glory is not in never falling, but in rising every time we fall.”

There are quite a few fund managers who could use those words for inspiration following the challenging year that was 2022. This is particularly true for small-caps managers who – due to the additional liquidity risks attached – always seem to find themselves in the eye of the storm.

“Encouragingly, some of the headwinds of last year have started to turn into tailwinds. The likes of energy costs; raw materials pricing; supply chain pressures; and China’s re-opening have all been positive factors. We’ve also seen volatility coming down.” That’s the view of Kirsty Desson, manager of the abrdn Global Smaller Companies fund.

Kirsty has been the fund’s co-manager since February 2020, before being promoted to lead manager in December 2021, when veteran small-cap manager Harry Nimmo stepped back. She joined abrdn in 2012 to focus on smaller companies within Asia, including Japan and emerging markets.

Targeting the world’s big companies of tomorrow, Kirsty employs the company’s proprietary screening tool, Matrix, at the start of her process. Matrix looks for four key factors: quality, growth, momentum, and value. Fundamental research will be undertaken on the financial accounts of a potential company.

The investment case is then verified with the management team, using the extensive database of company meeting notes, or further engagement. When valuing a company, Kirsty wants to see what expectations are built into the current price and identify the drivers that could lead to an increase. The result is a ‘best ideas’ list of circa 100 names, from which a portfolio of 50-60 holdings will be built.

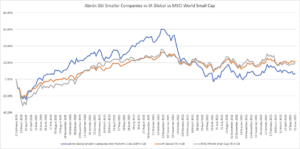

A snapshot overview of the past three years would show a modest return of 12 per cent*. The reality is that after a strong 2020 and a reasonable 2021, performance was hit hard by a myriad of factors in the first nine months of 2022, with the fund falling some 34 per cent as a result**. This started in January 2022 with the sharp value rotation – a factor which has always resulted in underperformance from the fund since its launch back in 2012.

“We thought the impact was going to be temporary given what we’d seen in late January and early February in terms of supply chains easing. It was almost too quick to react to, but we are long-term managers and we believed in the stocks that we held. But we had not anticipated war in Ukraine and the ongoing disruptions from the Covid lockdowns in China,” Kirsty says.

These events prompted a change in thinking on the outlook, resulting in a number of trades into companies which offered defensive growth attributes. Names like US discount retailer Five Below and French multinational GTT Group – which specialises in membrane containment systems dedicated to the transport and storage of liquified gas worldwide – were added.

Kirsty says the stocks added more recently are still outperforming the market, but not necessarily at 20-30 per cent clip. They offered predictable, recurring revenues and growth in the mid-teens.

Performance begun to stabilise and then pick up from the inflection point in markets in October 2022. Between then and now the fund has returned 8 per cent (vs. 5 per cent for the MSCI World Small Cap index)***.

Kirsty says the team are still seeing solid numbers come through on these defensive growth names, but the market is also starting to see a recovery in some early cyclical stocks. She cites European industrials as a good example of an area heavily exposed to the sudden shock to both energy prices and the cost of raw materials in 2022.

She points to German forklift truck manufacturer Jungheinrich as an example. She says: “They’ve seen a strong start to 2023, pushing through price increases, while also seeing raw material costs starting to flatten out. They had anticipated very high energy costs (which have not been as bad) and their order book is extremely strong.”

In addition to being well-known for outperformance coming out of recession, Kirsty says global small caps look incredibly attractive on a valuation perspective. This is not only relative to large caps but also from a regional perspective versus their own history. Asia Pacific is the only small-cap region where P/E valuations are trading above their 10-year average.

She says: “Markets do seem to be responding to better earnings since October 2022 and some of those macro-concerns have started to become more tempered and that is also reflected in the volatility data. All of this is positive for active fund managers, particularly for fund’s like ours where we are buying into bottom-up stock stories and are seeing companies beating expectations.”

Last year has shown there are periods when this fund will suffer. But it is a fund for reasons, and not for seasons. Aided by a strong team and process, it makes a very good contender to put in a portfolio for long-term exposure to an exciting asset class.

*Source: FE fundinfo, total returns in sterling, 25 February 2020 to 5 June 2023

**Source: FE fundinfo,, total returns in sterling, 31 December 2021 to 3 October 2022

***Source: FE fundinfo, total returns in sterling, 3 October 2022 to 7 June 2023

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.