The number of investors holding structured products as part of their portfolio has climbed over the past six years, according to data from the UK Structured Products Association.

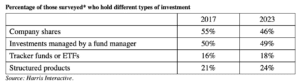

In 2017, one in five (21%) investors held structured products but that number has risen to one in four investors (24%) in 2023. Over the same period, holdings of other types of investment have remained relatively consistent or fallen. For example, the number of investors holding company shares fell from 55% in 2017 to 46% in 2023.

The UKSPA said their research had also shown a decrease in risk appetite, with an inclination towards products that protect capital and include ‘defensive’ features.

Preferred investment horizons are also decreasing, with almost half of investors surveyed favouring investing over a 0-5 year term.

Similarly, the overall number of investors in the UK has fallen back to 2019 levels, while the average level of investable assets has dropped from £164,000 in 2021 to £128,000 this year.

In contrast, demand for ESG has risen, with investors wanting over 60% of their portfolio to have an ESG focus compared to 50% two years ago.

Zak de Mariveles, chairman of The UK Structured Products Association, said: “Since we first started conducting our research into the needs of UK investors in 2017, we’ve documented a consistent trend in the increased use of structured products across all types of investor, from the least experienced to the most knowledgeable. And all evidence points to this trend continuing into the future, as investors seek solutions that can protect their capital and generate returns even when markets are falling.”

*Survey respondents are those who are aged 18+, financial decision makers, either hold investment products or are likely to in the next 2 years, and who have investable assets of at least £5,000.