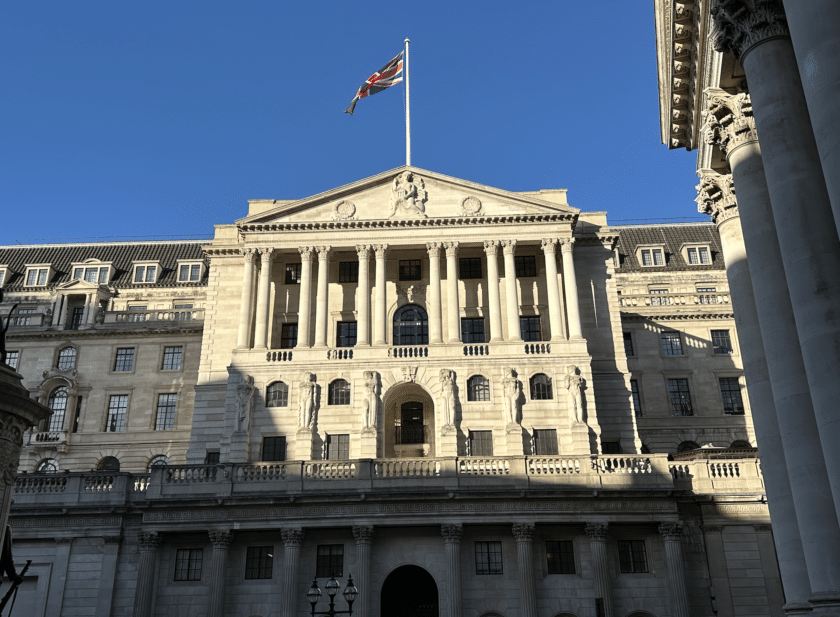

Laith Khalaf, head of investment analysis at AJ Bell, considers the potential Bank of England decision on interest rates on Thursday and how it may affect markets and the upcoming Budget.

The latest reading for UK inflation was heading in the wrong direction, only very slightly, but enough to give the Bank of England pause for thought.

Not that some rate setters need any encouragement to be hawkish, seeing as three of the nine members of the Monetary Policy Committee actually voted to tighten policy at their last meeting. A sticky inflation reading seems unlikely to have talked them down from their perch.

Short term interest rates fell back considerably in the last few months of 2023, providing some relief for mortgage borrowers, but it feels like the market may have got over-excited about looser monetary policy in the UK. So far this year, expectations for interest rate cuts have retreated a touch, but market pricing still suggests there will be four rate cuts this year, starting in May or June. That’s pretty punchy.

The market is convinced the Bank will sit on its hands at the forthcoming meeting, but the rhetoric around the decision, the economic forecasts produced, or the split of the committee vote may well move interest rate markets, and that could have implications for the chancellor’s fiscal headroom in the March Budget. If interest rates rise on the back of the meeting, that will push up the cost of government borrowing, and down on the chancellor’s wriggle room.

The OBR closes its budgetary forecasts to new economic data on 14 February, so will encompass any fallout from this week’s interest rate decision.

It seems unlikely anything apart from a rate hike would move interest rates in a material way, but the market is poised for so many rate cuts this year, it might well be sensitive to lesser challenges to the prevailing narrative. Much will likely depend on the Bank of England’s assessment of current monetary conditions.

If the Bank wants to send a signal that markets have got ahead of themselves, this week’s interest rate decision provides a golden opportunity to do so.