In the fourth installment in her monthly column on cash flow, Steph Willcox, head actuary, Dynamic Planner looks at clients reaching the stage of life where they are thinking about retirement.

You’re likely to be inundated with queries from clients in the pre-retirement life phase wanting to understand when they can retire, and what their retirement will look like. For some clients this will be the first time they have sought financial advice, and the first time they have taken an interest in their pensions and retirement provisions.

These clients may still have competing goals like paying off their mortgage or trying to save money for the next generation to inherit, as well as helping out children with house deposits, university fees or general life.

What should you focus on?

If this is the first time you are meeting a new client, then you need to ensure you understand them as a person. This will include assessing their attitude to risk, their capacity for loss and their experience of investing so far. This will help to shape the coaching you can provide to your clients and the value you can add to their financial life plans. You will also need to ensure that the method of assessing the attitude to risk of your clients is suitable for use in decumulation as well as accumulation.

It’s also going to be very important to show clients exactly what type of retirement they are on track for, especially if they don’t have a clear vision of their future selves or an understanding of what level of income, they might be able to sustain throughout their retirement. They will still be able to improve their situation, but starting with their current position will help set conversations around what they are willing to compromise on, and what they are not. For example, they may be willing to postpone retirement or work part time to support their retirement income to help their retirement plans.

You may also want to start showing your clients what different types of retirement strategies look like to assess their preferences for guaranteed income against flexible income, and their ability to make irreversible decisions against flexibility. By showing them different scenarios, and comparing the benefits and risks of each, you can start to understand the retirement strategy that fits their retirement needs. You can model blended retirement strategies where some of their retirement pots are used to

provide guaranteed income for life, and the rest is drawn down from as required. A client’s reaction to this demonstration will help to understand exactly where their preferences lie.

It will be vital to demonstrate how long their portfolio will last under different investment assumptions. This is done naturally through a stochastic cash flow model, or you can change the assumptions yourself within a deterministic model to ensure that you are capturing the potential of poor performance through decumulation.

You can show the effects of different retirement ages, alongside different retirement incomes, as well as showing them how they can improve this through saving more now, working a bit longer, or reconsidering what they will spend their money on in retirement.

What is less important

Although estate planning is bound to come into your conversations, legislation around this can still change greatly before or during retirement so shouldn’t be the main focus of your advice.

Protection policies will naturally decrease in importance as clients age, although you may still want to demonstrate the impact of having one life die early into retirement to see if the surviving client can support their retirement plans if the worst should happen.

In summary

At the pre-retirement phase of life clients have a lot of uncertainties about what their retirement will look like, and as advisers you can really help to shape and imagine retirement for each client that walks through your door.

Spending time getting your clients to understand the options they have at each stage of retirement, in terms of when it occurs, and how much income they can take from their investments to ensure they do not run out of money will be important at this stage. Bringing their retirement to life through engaging visuals can really help your clients to understand exactly what they have been saving for and how the decisions they make today will determine their future.

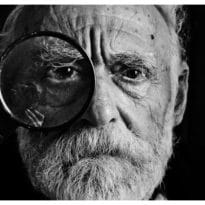

Main image: sean-sinclair-C_NJKfnTR5A-unsplash