The negative performance of both equities and bonds in 2022 was highly unusual, with a 60/40 portfolio of US assets enduring one of the worst ever years. While forecasting is a difficult business, Global Head of Solutions & Multi Asset Henk-Jan Rikkerink outlines why we expect bonds to become less correlated to risk assets in 2023, underpinning our increasingly positive view on high quality fixed income.

What will 2022 be remembered for? The beginning (and it is disheartening to have to add that qualifier) of the war in Ukraine will rightly be the first entry under 2022 when the history books are written. But for markets, the Fed was the only game in town. Runaway inflation and major central banks’ aggressive monetary tightening, spearheaded by the Fed, dominated the market narrative for the year.

The rapid rise in yields drove bonds to one of their worst ever years and caused longer-duration equity multiples to plummet. Slowing growth and tighter financial conditions weighed on equities more generally.

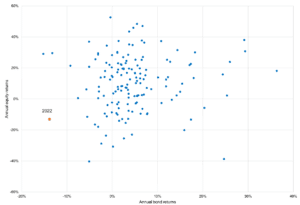

Nominal annual returns 1872 – present: 2022 is an outlier

Past performance is not a guide to the future.

Annual nominal returns of S&P 500 and US 10y Treasuries 1870-2022; data for 2022 is year to 01/12/22. Source: pre-2021 data from Òscar Jordà, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan M. Taylor. 2019. “The Rate of Return on Everything, 1870–2015.” Quarterly Journal of Economics, 134(3), 1225-1298, post-2020 data from Refinitiv, Fidelity International, December 2022.

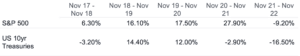

While not quite unique, the negative performance of both equities and bonds makes 2022 highly unusual, as the chart above shows. The chart below, meanwhile, reveals that there have only been a handful of times that a 60/40 portfolio of US assets has performed worse in the last 150 years.

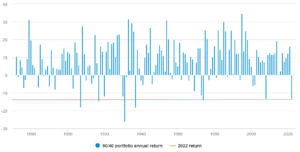

2022 was among the worst for a US 60/40 portfolio in the last 150 years

Past performance is not a guide to the future.

Annual nominal return of 60/40 portfolio of S&P 500 and US 10y Treasuries, 1870-2022; data for 2022 is year to 01/12/22. Source: pre-2021 data from Òscar Jordà, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan M. Taylor. 2019. “The Rate of Return on Everything, 1870–2015.” Quarterly Journal of Economics, 134(3), 1225-1298, post-2020 data from Refinitiv, Fidelity International, December 2022.

So what can we expect in 2023?

A recession, among other challenges, which is why we are still defensively positioned overall. However, we do not expect bonds to perform so poorly, or to be as positively correlated to equities next year, and we have recently moved overweight government bonds.

Forecasting is a difficult business. Financial history, indeed all of history, is littered with bombastic claims about the significance of recent events that are exposed as naïve or foolish with the benefit of hindsight. However, even with this in mind, we believe 2022 will mark a significant shift in how a generation of investors, policy makers and consumers will think about inflation and interest rates. Not only does it appear that the post-financial crisis era of cheap money and quantitative easing is definitively over, but also the era of low inflation and ever-decreasing rates that investors had grown accustomed to since the early 1980s.

Our team continues to analyse the investment implications of this regime shift, both from a tactical perspective as well as in the medium and longer-term.

Learn more about Fidelity Multi Asset

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Changes in currency exchange rates may affect the value of investments in overseas markets. Investments in emerging markets can also be more volatile than other more developed markets. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority and Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM122/380668/SSO/NA