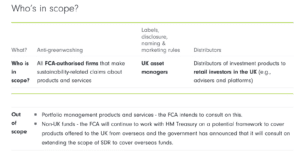

The roll-out of new measures related to Sustainability Disclosure Requirements (SDR) will begin in May when anti-greenwashing rules come into effect. Here, the Fidelity International Sustainable Investing team provides an overview of the regulations, what they mean for advice firms investing into sustainable funds.

The FCA published its Policy Statement (PS23/16) on 28 November 2023 setting out the final rules and guidance on SDR. This followed the FCA’s Consultation Paper (CP22/20)in October 2022 and Discussion Paper (DP21/4) in November 2021. The Policy Statement introduces a package of measures that are aimed at helping consumers navigate the sustainable investing market, enhancing transparency and preventing greenwashing. These include:

• An anti-greenwashing rule

• Naming and marketing rules

• Four investment fund labels

• Comprehensive product and entity-level disclosures

• Distributor requirements

Implementation timeline

Anti-greenwashing rule & guidance

SDR introduces a firm-level ‘anti-greenwashing rule’, which requires that any references to the sustainability characteristics of a product or service be: i) “consistent with the sustainability characteristics of the product or service”; and (ii) “fair, clear and not misleading”. Whilst this builds on existing regulation, the anti-greenwashing rule gives the FCA an explicit basis on which to challenge firms’ sustainability claims and to take enforcement action where required. We anticipate the FCA will release its final guidance to aid firms in complying with the rule in the upcoming months, prior to the implementation date of 31 May 2024, following the recent conclusion of its consultation on anti-greenwashing guidance (GC23/3).

Naming & marketing rules

Only labelled products can use the terms “sustainable”, “sustainability”, and “impact” in their names, with “impact” exclusively for those with the “Sustainability Impact” label, subject to strict criteria and disclosure standards.

Non-labelled products may use other sustainability-related terms like “ESG”, “green”, and “low carbon”, provided they demonstrate at least 70% of the portfolio aligns with declared sustainability characteristics, accurately reflected in their naming and marketing. Non-labelled products that use ESG related terms in their name and/or make significant references to them in marketing documents in line with their approach must also adhere to the same comprehensive disclosure standards as required for labelled products, as well as providing a statement to clarify why the product does not have a label.

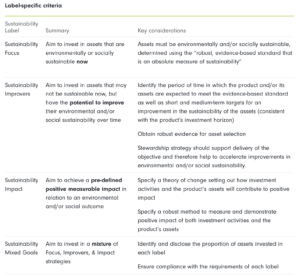

Sustainability labels

SDR introduces four investment labels that aim to improve or pursue positive outcomes for the environment and/or society. There is no intended hierarchy between labels as consumers will ultimately place the labels into their own hierarchies according to their needs and preferences. To qualify for a label, products must meet general and label-specific criteria on an ongoing basis.

General criteria

Products must have:

• A sustainability objective

• At least 70% of gross assets meeting the sustainability objective

• KPIs to track the achievement of or progress towards the sustainability objective

• Adequate resourcing and governance to support delivery of sustainability objective

• Disclosures on how stewardship strategy supports delivery of sustainability objective.

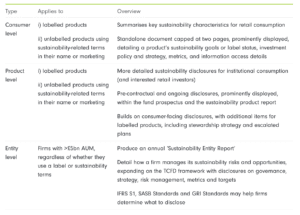

Disclosures

There are three tiers to the disclosure requirements under SDR with the key features highlighted below.

Distributors

Distributors are required to promptly provide retail investors with labels and access to consumer-facing disclosures through digital platforms or customary communication channels. They must ensure these labels and disclosures are current, reflecting any updates.

Additionally, for overseas products, distributors must post a notice stating these products do not adhere to the UK’s sustainable investment labelling and disclosure requirements. Notices must be placed prominently on the relevant digital medium, with a link to further FCA information, or communicated through distributor’s standard channels.

Action points

• Prepare for the anti-greenwashing rule: i) review and revise (if appropriate) greenwashing policies; ii) ensure marketing, client communications and disclosures accurately reflect sustainability features. Upon release, review FCA’s final guidance on anti-greenwashing for compliance expectations.

• Review existing product range: assess current range of products against the labelling criteria, as well as naming and marketing rules, to identify any changes that may be required.

• Engage your asset managers: SDR avoids introducing a single metric or defined term to compare sustainability performance between funds or managers, so investors should engage with their asset managers to understand their approach and implementation of the SDR requirements.

• Identify opportunities: Morningstar estimates that up to 300 funds will opt for SDR labels in 2024 with Sustainability Focus likely the dominant label, followed by Sustainability Mixed Goals then Sustainability Improvers and Sustainability Impact. Morningstar predicts that equity funds could represent over half of the labelled product universe, while fixed income and passive funds will be significantly under-represented[1].

For more information and detail, you can visit the FCA’s website

[1]UK SDR Through the Looking Glass, Morningstar Research January 2024

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. A focus on securities of companies which maintain strong environmental, social and governance (“ESG”) credentials may result in a return that at times compares unfavourably to similar products without such focus. No representation nor warranty is made with respect to the fairness, accuracy or completeness of such credentials. The status of a security’s ESG credentials can change over time.

Main image: artur-luczka-loAfOVk1eNc-unsplash