Tigran Manukyan, portfolio manager and senior manager research analyst, Daniel Ryan, manager research analyst, Fidelity Solutions and Multi Asset team, consider the interaction between private and public markets.

The amount of money invested in private assets has ballooned over the last 20 years. Total assets under management is now in excess of US$7tn and is expected to reach US$13tn by 2025, according to Preqin. There have been several drivers of this trend.

The relative paucity of potential returns on offer in public markets since the financial crisis has led many investors to pursue the illiquidity premium, which is the potential return compensation for the lack of immediate access to liquidity that public markets provide. The flow of capital shows little sign of diminishing in the near future given that bond yields are so low and equities are expensive, leading investors to seek other options in their portfolios. Private assets also have the benefit of infrequent pricing, insulating investors from the daily gyrations of public markets.

The rapid growth of private assets

Source: Prequin, November 2021. 2021-2025 forecast. Includes private equity, private debt, and unlisted real estate, infrastructure and natural resources.

There are several ways in which investors in public markets can take advantage of this influx of private capital. The first and most obvious way is to buy the shares of publicly listed managers of alternative assets. In the current goldrush of private capital, these are the pick and shovel sellers. They make money from a mix of stable management fees as well as ‘carry’ – fees based on how well the assets perform. The stronger franchises should continue to attract assets as capital continues to flow towards private markets.

Investors must tread carefully though. Perhaps ironically, unlike the accounting of the underlying investments, the publicly listed shares can be highly volatile. And given their recent strong run, investors might already be pricing in a continuation of the surge in private flows, leaving shares vulnerable to a correction if the good news fails to materialise. The shares have a high beta to financial markets in general, meaning their performance could suffer as a result of equity and credit market setbacks even as organic AUM growth continues.

A second way to ride the wave of private capital is to take advantage of the volatility of public markets to buy assets that have the characteristics most prized by private market investors. For example, GCP Student Living, which owns student accommodation in the UK, was an investment for our team between 2018 and 2021.

During the initial phase of the Covid pandemic, GCP was punished by markets because of the greater uncertainty over future occupancy rates. We judged that the long-term fundamentals of the assets were still sound, and the strong liquidity position of the company would allow it to weather the short-term storm. While the investment thesis was not reliant on this outcome, we had also noted GCP’s potential attractiveness to private buyers as an additional cushion. We added to our position as well as buying other student accommodation names.

Having already started to recover, earlier this year GCP Student Living was the subject of a takeover bid at a healthy premium to its share price. Public markets occasionally give opportunities to buy quality assets at steep discounts, which can offer healthy returns for patient investors with a long-term return horizon. And by buying the types of asset most in demand by private investors, the vast amount of private capital may help to realise this value sooner than anticipated.

Lastly, public market investors can gain by being an early mover in emerging asset classes. Companies might be staying private for longer, but investors in public markets still have opportunities to invest in the ‘next big thing’. Publicly-traded alternative investment companies can provide exposure to a variety of alternative sectors including transport infrastructure, undersea cabling, renewable energy, and shipping. Many IPOs in this area have been in what were comparatively esoteric sectors that have since seen a rush of interest and come to be regarded as asset classes in their own right, with mainstream investor participation both in public and private markets.

The sheer weight of money in private capital has driven gains in such assets, given the limited supply of high-quality assets compared to huge demand. An example of this is big box logistics warehouses, which were considered a specialist asset when we first entered the space in a 2013 investment in Tritax Big Box REIT. Now logistics assets are considered alongside mainstream property segments such as retail and office. The flood of capital into the sector has driven prices up and yields down to the benefit of early investors.

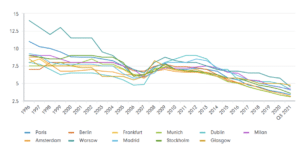

Yield compression in logistics has benefitted early investors

Source: Jones Lang LaSalle, November 2021. Data to Q3 2021.

We are potentially witnessing something similar in several areas now. One is the music royalties space. There were two successful IPOs of companies offering exposure to music royalties between 2018-2020 when the concept was relatively new. The space is now attracting the interest and capital of large, household-name private asset managers to the potential benefit of early investors in these assets.

Green infrastructure is another area that has seen a number of recent IPOs, including opportunities to back developments of new solar, energy storage, and renewable electricity projects in emerging markets. There have also been several IPOs of energy efficiency strategies, which aim to reduce the emissions of intensive sectors, with on-site energy systems and improvements to the efficiency of existing infrastructure. As an example, the recent IPO of Atrato Onsite Energy PLC was heavily oversubscribed. Subject to good operational results and continued delivery against their sustainability goals, this weight of investor capital looking for such assets can once again boost the returns generated by early investors.

A note of caution though. A rush of capital into a new sector can also bring about poor returns given the time and context, whether this be through oversupply of an asset or by tempting managers to allocate the abundant capital to increasingly unattractive projects. A selective and deliberate approach is required.

An enduring theme

Investors are trying to make their capital work harder than ever before in a world where expected returns are lower. This makes the growth of private capital an enduring theme. And while the money keeps flowing into private markets, it is important to understand the interaction between private and public markets.

The relationship is often thought of as a one-way street, of IPOs where private companies are finally made available to hungry public investors amid much fanfare. But the reality is now also one of private investors fighting for the right public assets. Good research that looks for high-quality and undervalued assets is as valuable as ever and public investors can also gain from the wall of money on the other side of the divide.

Interested to learn more about Fidelity Multi Asset?

Fidelity range of multi asset solutions

Important information

This information is for investment professionals only and should not be relied upon by private investors. The value of investments (and the income from them) can go down as well as up and you may not get back the amount invested. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Fidelity’s range of fixed income funds can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Due to the greater possibility of default, an investment in a corporate bond is generally less secure than an investment in government bonds. Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes. Investments should be made on the basis of the current prospectus, which is available along with the Key Investor Information Document (Key Information Document for Investment Trusts), current annual and semi-annual reports free of charge on request by calling 0800 368 1732. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0122/370209/SSO/NA