Technology stocks have fuelled the growth stock boom, particularly during the pandemic when business and consumer use of digital accelerated. So, what happens post pandemic? IBOSS senior investment analyst, Chris Rush takes a view.

Growth stocks, and particularly technology stocks, have been the primary focus of investors for close to a decade. These companies have managed to thrive through innovation in a world of monetary easing, low interest rates, and slower growth. From an investor perspective, this innovation has stimulated growth by stealing market share from their less tech-savvy competitors.

Natural adoption and utilisation of digital goods and services

While this will come as news to almost nobody, it is worth taking a step back and considering that many of these digital services have only really been fully adopted within the last decade. So, whilst this digitalisation remains a relatively recent phenomenon, our reliance on, for example, Google and Amazon for everyday activities, for now seems unavoidable.

The point is perhaps best evidenced through the smartphone adoption rate, which rose from 1 Billion in 2012 to 3.6 Billion by the end of 2020 – a 360% increase. More surprisingly perhaps, smartphone adoption saw its most significant uptick in 2016, growing 34.4% in a single year (data from Oberlo.co.uk).

It is often quoted that ‘correlation does not equate to causation’, however, the companies that have benefitted most acutely by the adoption of technology have been those that have replaced the desire for physical assets with a digital equivalent. Netflix is a clear example, as they provide access to digital films and TV shows, making DVDs and box sets as close to redundant as they have ever been. The same is true for Amazon, which effectively replaced the need for a physical store by making its digital shop and online delivery as, or even more, convenient than the high street.

Forced adoption and utilisation of digital good and services

The natural uptake of technology and the shift away from physical assets to digital assets received a significant, and unexpected, boost in 2020 as governments globally enforced lockdowns to counteract the pandemic. This resulted in consumers being compelled to use more digital goods and services than ever before in the absence of any physical equivalent, such as Netflix, Google, Microsoft (Teams), Zoom and Deliveroo. Again, a factor that was very much reflected in each company share price.

In short, the pandemic has accelerated digital transformation through forced adoption. A study by McKinsey & Company highlights that the number of digital interactions has increased dramatically as the share of digital products sold by companies has accelerated by circa seven years, and the digitisation of company operations has accelerated by 3-4 years.

Slowing digitisation, positive vaccine news and the value rally

Lockdowns were an unwanted by many, but were deemed a necessary result of the COVID situation. This has undoubtedly forced consumers and companies to digitise faster than they otherwise would have.

The scenarios above have been unequivocally positive for companies pursuing the digital agenda and unequivocally negative for those selling physical assets in their many forms.

However, barring another global lockdown, we are finding it increasingly difficult to visualise a scenario that would be even more positive for technology firms. Thus, we would hazard to guess that there will be some degree of reversal from lockdown level digital usage from here.

We are not, by any means, implying that these companies will collapse. We are, however, saying that the outlook is perhaps more muted from here and maybe the digitisation tailwind will be lessened in the coming decade. We may look back on this period as a time when digitisation usage was, to a degree, just brought forward rather than it all being accretive to the sum of digitisation.

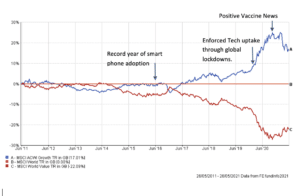

We need only look at the price of many growth assets on the announcement of a COVID-19 vaccine. The stocks which performed the best in the initial stages of lockdown have underperformed. Physical assets – many of which sit in the value sector – have seen a resurgence in the form of restaurants, pubs, cinemas, commodity prices and travel companies.

These changes coupled with increasing fiscal spending and a more positive inflation outlook could mean that the winners of the next decade could look very different to the last. We look to ensure that the IBOSS portfolios are as diversified as possible. This means we balance the tech (growth) winners of the past decade and a weighting toward those companies with old school tangible assets.

Growth vs Value over a decade relative to MSCI World (to 26/05/2021)

This communication is designed for Professional Financial Advisers only and is not approved for direct marketing with individual clients. It does not purport to be all-inclusive or contain all of the information which a proposed investor may require in order to make a decision as to whether to invest or not. Nothing in this document constitutes a recommendation suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a personal recommendation.

Past Performance is no guarantee of future performance. The value of an investment and the income from it can fall as well as rise and investors may get back less than they invested. Risk factors should be taken into account and understood including (but not limited to) currency movements, market risk, liquidity risk, concentration risk, lack of certainty risk, inflation risk, performance risk, local market risk and credit risk.

Data is provided by Financial Express (FE). Care has been taken to ensure that the information is correct but FE neither warrants, neither represents nor guarantees the contents of the information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Please note FE data should only be given to retail clients if the IFA firm has the relevant licence with FE.