Sponsored article

For professional advisers and paraplanners only.

Not to be relied on by retail clients.

By Jess Franks, Head of investment products at Octopus Investments

Venture Capital Trusts (VCTs) might not be something you recommend every day, but they warrant attention. Read on to find out why.

There’s certainly good appetite from advisers and clients right now who are hungry for investments that deliver strong post-tax outcomes and diversification. They’re so hungry, in fact, over £1 billion was invested into VCTs in the 2022/23 tax year1.

So why should you consider VCTs for your clients this tax year? Here are a few of the reasons.

A quick reminder of VCTs

VCTs are listed companies that invest in a diversified portfolio of early-stage businesses. They support innovation in the UK by encouraging investment in smaller, unquoted, and AIM-listed companies.

Because these smaller companies are high risk, VCTs offer attractive tax reliefs (including 30% income tax relief and tax-free dividends) to compensate investors for some of the risk involved.

Since their introduction in 1995, VCTs have grown to become a mainstay of many advisers’ proposition. For suitable clients they are a valuable way to invest tax-efficiently for the future, and to add diversification to an investor’s portfolio.

Understanding the risks:

- The value of a VCT investment, and any income from it, can fall as well as rise. Investors may not get back the full amount they invest.

- VCT shares could fall or rise in value more than other shares. They may also be harder to sell.

- Tax reliefs depend on a VCT maintaining its VCT-qualifying status.

- Tax treatment depends on individual circumstances and tax legislation may change in the future.

Reason 1: Target an attractive post-tax outcome

VCT investors can claim 30% upfront income tax relief on up to the first £200,000 invested each tax year, provided shares are held for at least five years.

As for returns, VCTs typically target a dividend yield of 5% of NAV (net asset value), which is free from tax.

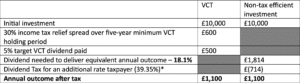

A non-tax efficient investment would need to pay around an 8% annual dividend to generate an equivalent post tax income for investors. If the benefit of initial income tax relief is also factored in, a non-tax efficient investment would need to pay around an 18% annual dividend to create an equivalent post tax outcome. This assumes the benefit of income tax relief is spread across the five-year minimum holding period.

This combination of income tax relief and tax-free dividends make VCTs an attractive income planning tool. Investors can access the higher levels of post-tax target returns associated with taking on more risk, while benefitting from the tax relief.

We’ve shown how this looks for an additional rate taxpayer in the table below.

*Assuming dividend allowance used elsewhere

The above example assumes no loss or gain on initial investments and does not factor in any initial or exit charges. Returns and tax reliefs are not guaranteed. VCT investments have a higher risk profile compared to a mainstream, non-tax efficient investment fund. Note that a non-tax efficient investment can be held within an ISA, in which case it would benefit from tax free dividends. However, annual ISA contributions are limited to £20,000 a year.

Reason 2: Diversification

With a VCT, your clients gain access to early-stage unlisted companies, an asset class many clients will have little to no exposure to.

Early-stage companies have a higher rate of failure when compared with more mature businesses. But these companies can also be nimble – light on their feet – and able to respond quickly to economic shocks and opportunities.

The result is that unlisted companies are a unique asset class with the potential to be less correlated to the wider listed markets. This can have diversification benefits within a portfolio.

For this reason, it is worth considering VCTs for a broader base of clients than you might initially think.

Dr Brian Moretta, Head of Tax Enhanced Services at Hardman & Co, researched the effect of adding venture capital to client portfolios.

While you can build a higher risk portfolio for a client by allocating to venture capital, Dr Moretta found that clients can increase their exposure while managing portfolio risk by rebalancing their portfolio (disproportionately increasing the weighting of lower risk assets).

Dr Moretta’s research found that by adding relatively small exposures to venture capital, investors could improve potential annual returns by 0.5% to 1%2 without changing the overall portfolio risk. While this might not sound like much, the impact of compound returns could be significant and this incremental return does not factor in tax reliefs.

You can read more in our whitepaper, co-authored with Hardman & Co, How to add venture capital to a portfolio while considering risk >>

Reason 3: The growing need for tax planning

Lots of investors want and could benefit from tax planning.

Today, with frozen income tax thresholds and wage inflation, we are seeing an increase in the number of higher and additional rate taxpayers.

Business owners and landlords have also been impacted by the tough tax climate we find ourselves in today.

This all makes VCTs a worthwhile consideration. Why? Because you can recommend an investment that not only supports your clients’ investment objectives but also has tax benefits.

Reason 4: It makes good sense for your business

When it comes to recommending VCTs, there are commercial benefits for your business. VCT cases are typically small – the median case size we see is £15,0004 – but they all add up as clients tend to repeat invest every year.

These recommendations are a great way to demonstrate your expertise, helping you build a robust advice business.

And at a time when we’re all thinking more than ever about the value of advice under Consumer Duty, it’s worth considering how VCTs can support you in delivering good outcomes for your clients.

Take a look at our planning scenarios to see where VCTs fit into your client bank

Reason 5: Your clients’ unmet appetite and opportunities to advise

Discussing VCTs with your clients gives you an opportunity to advise on both tax planning and early-stage investments. This is a typically underserved sector, where our research shows investors have unmet appetite.

Among 200 UK financial advisers, just 17% thought their clients were interested in investing in early-stage companies. Yet when 1,000 UK adults with investments partly or fully managed by an adviser were asked the same question, 45% expressed interest3.

Where clients are suitable, VCTs are a way to offer access to private, early-stage companies within a diversified portfolio and with tax reliefs to compensate for some of the risk being taken.

1The return of VCTs, the Association of Investment Companies, 29 September 2023

2This return figure doesn’t consider the impact of any tax reliefs that may be available when investing in venture capital.

3Survey of 1,020 UK Adults with investments partly/fully managed by an adviser and 206 UK IFAs, Opinium Research, April 2023.

4Octopus Investments, January 2024.

VCT investments are not suitable for everyone. Any recommendation should be based on a holistic review of your client’s financial situation, objectives and needs. This communication does not constitute advice on investments, legal matters, taxation or any other matters. Personal opinions may change and should not be seen as advice or recommendation. Issued by Octopus Investments Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 33 Holborn, London EC1N 2HT. Registered in England and Wales No. 03942880. Issued: February 2024. CAM013606.