Annuity investors should ensure they explore the myriad of guarantee options available rather than seek maximum income, says Canada Life.

According to the retirement specialist, by choosing the right length of guarantee and shape of annuity at the outset, customers can ensure that their annuity will return not only the original purchase value but also a “significant return” on their original premium.

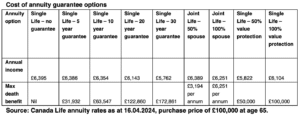

Analysis by Canada Life found that a 30 year guarantee showed a return of 73% on the original purchase price from the annuity, plus the original capital back. Selecting this option would reduce the annual income by £633 but would guarantee at least £172,861 from a £100,000 purchase price.

Opting for a shorter annuity period such as 20 years would reduce annual income by £252 but would deliver at least £122,860 to the customer.

Canada Life has called for wider consideration of the various options available around death benefits from annuities, with data from the FCA showing that around three out of four annuities sold come with guarantees attached but in reality, most are much shorter guarantee periods, typically five or 10 years.

Nick Flynn, retirement income director at Canada Life, said: “Annuities are the unsung hero of retirement income and the myriad of guarantee options should not be discounted in favour of maximising income. In times of uncertainty, annuities provide a risk-free guaranteed retirement income and if the right shape and guarantees are chosen at outset, they provide significant peace of mind for both clients and those nearest and dearest to them.

“While the shortest guarantee periods are currently chosen as the norm due to the higher incomes available, the longer guarantees effectively offering your ‘money-back’ shouldn’t be ignored, given the way the annuity market has evolved and rates improved over the past 18-months.”

At the start of 2022, a benchmark annuity with a £100,000 purchase value would pay around £4,540 a year for someone aged 65 with no health or lifestyle conditions. At the start of this year, the same annuity would pay around £6,431 a year, driven higher by interest rates and the returns available on gilts.

Main image: pawel-czerwinski-ERcQ81KaX9g-unsplash