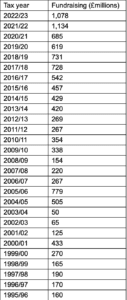

Funds raised by Venture Capital Trusts surpassed £1 billion in the 2022/23 tax year, according to figures from the Association of Investment Companies.

In total, VCT fundraising reached £1.08 billion, only the second time it has passed the £1 billion milestone, following a record £1.13 billion raised in 2021/22.

During the course of 2022, VCTS invested £700 million in new and follow-on investments in small private companies and AIM-listed companies, with £652 million invested in private companies and £48 million in AIM-quoted enterprises.

The AIC said the amount raised will be “highly beneficial” to small businesses in a challenging environment.

Richard Stone, chief executive of the Association of Investment Companies said: “This much-needed support to the UK’s fast-growing companies helps deliver vital economic, social and environmental advantages to the country. It’s crucial VCTs can continue to fund young businesses which create jobs, develop skills and knowledge, increase exports and raise the tax take across many sectors including healthcare and technology.

“During a tough year for investors, demand for VCTs remains near record levels demonstrating the numerous benefits they bring. VCTs have been around for over 25 years and are a trusted tax-efficient scheme. They have strong long-term performance, with the average VCT returning 108% over ten years. Following the pandemic, private investors are particularly interested in supporting the UK’s entrepreneurs and their innovative high-growth companies.”

Historic VCT fundraising excluding enhanced share buy-backs

[Main image: adeolu-eletu-rFUFqjEKzfY-unsplash]