Research of data from the past 20 years by Canada Life, confirms that shopping around for an annuity can earn pensioners thousands in extra income.

New data from the insurer found that over a 20-year period, the difference between the best and worst annuity in the open market was an additional £13,240 in income, or £662 a year, based on a £150,000 pension.

However, Canada Life said in reality the gap could be even greater as many providers do not openly publish their annuity rates.

Nick Flynn, retirement income director at Canada Life, said: “Once you’ve taken the decision to convert your pension into a lifetime income using an annuity, never simply accept the offer from your existing pension company, as you may not always get the best deal. The decision can’t be reversed, so it’s vital to take the time to make an additional step in the process, and shop around for not only the best rate, but the right shape annuity for your individual circumstances.”

Flynn warned that with “considerable interest” from customers seeking to capitalise on today’s generous annuity rates, it can be easy to lose sight of some of the simple measures pension savers can take to extract as much value from their pension as possible.

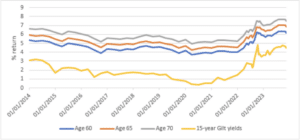

Today, a benchmark annuity for someone aged 65 with no pre-existing health or lifestyle conditions would pay in the region of 7%. However, this rate can increase significantly when disclosing common health or lifestyle conditions such as diabetes, high blood pressure or smoking.

Flynn added: “Even in one of the straightforward scenarios, our calculations show the difference in income over a typical 20-year retirement can add up to thousands of pounds. That’s before you factor in health and lifestyle related questions, which can add additional income. Shopping around for the best deals on car insurance, securing the best mortgage rate or getting a great deal on the high street is now common-place, and so should be getting the best from your hard-earned savings.”

How lifetime annuity rates have changed over time

Source: Canada Life annuity rates over time, as at 27/11/2023