Income fund management is a different approach to managing money, says David Jane of the Premier Miton Macro Thematic Multi Asset Team.

The benefits of using natural income rather than drawing capital are poorly understood. It is in this area that multi asset income funds really come into their own. However, in our view, there are not enough true income funds, given the importance of natural income. We would welcome some more competition.

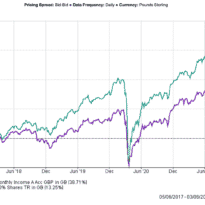

Our outcome led approach to fund management means that we focus on client needs first. In the case of our income fund (Premier Miton Cautious Monthly Income Fund), this means that the requirement for a growing monthly stream of income over time is the priority. This of course cannot reasonably be expected unless we are also able to maintain and grow the capital value over time. This order of priorities means that we start with the income objective.

One good thing about income management is that income is much more predictable than capital returns. Our intention to pay a consistent monthly payment, which is maintained or raised annually, with a larger payment in June each year. We expect the overall distribution to grow over time.

Having some visibility on the future income stream is key. As a directly invested fund, we know exactly what assets we hold each day and can, therefore, predict the income which is expected to come into the fund with a fair degree of accuracy. In the case of bonds, this is relatively straightforward, bond income is accrued daily. For equities and other dividend paying assets it is more complicated. We know past dividends and dividends already declared but for future dividends, we must rely on forecasts. Thankfully, dividends are much more predictable than company’s earnings and most companies avoid cutting the dividend if at all possible. Future dividend dates are also known with reasonable accuracy. Using consensus forecasts, we model the fund’s income, month by month into the future. In this way, we can meet our clients’ income expectations by design and actively managing the process of earning that income. We re-forecast regularly and if the outlook changes we can adjust the portfolio appropriately.

Income may be the primary objective but total return is inevitably important too. We do not want to be paying out income at the expense of capital. We must also conserve and grow our capital. Our tried and tested macro thematic investment strategy followed across our range, mixes long-term thematic growth situations with shorter term macro-economic opportunities. Over time, successful growth investments need to be trimmed, for risk reasons, providing gains we can reinvest to grow the income.

The process works also in down markets. Success in protecting capital into sell offs, either through having good diversifiers or simply by selling early, creates the opportunity to build the income into the recovery.

In our view, an income fund is not simply a fund of attractive income paying investments. It is a diversified fund of investments, which overall will meet the clients’ income needs. It must grow that income over time, while providing the appropriate risk and capital profile. It is the fund overall that is providing that income, every underlying investment. As always in investment appropriate diversification is important.

A common misunderstanding with income funds is that they are managing the yield. Some funds may do this, but we feel a better strategy is to focus on the distribution the client receives. We focus on the distribution. The income per unit when the client bought the fund should be maintained or grown wherever possible, irrespective of the fluctuations of the market which determine the yield.

We think the key to managing income funds is to set the income distribution as your objective. It is one thing to name a fund an income fund, then buy some relatively high yielding investments, it is quite another to manage the income itself. In our view, clients should select income funds on their demonstrated ability to actually manage and grow income over time. While capital returns must also be a consideration, unless the fund is providing a predictable and growing income it cannot be used as a core component of a natural income strategy.