One swallow doesn’t make a summer; but one UK data point might bring a ray of sunshine, writes Luke Hyde-Smith, Co-Head of Multi-Assets at Waverton.

Wednesday 19th July saw the release of the UK inflation data for June. Having surprised to the upside the month before, prompting a 0.5% increase in the UK base rate from the Bank of England, all eyes were on this data point to determine how acute the UK inflation problem had become.

Omens were positive from the global data. US inflation had dropped sharply from the levels seen in late 2022, while China is flirting with outright deflation. However, the UK’s well reported inflationary conundrum of rising wages, higher energy costs and imported cost push-inflation from the fall in sterling in the latter part of 2022 has resulted in a stubbornly high rate.

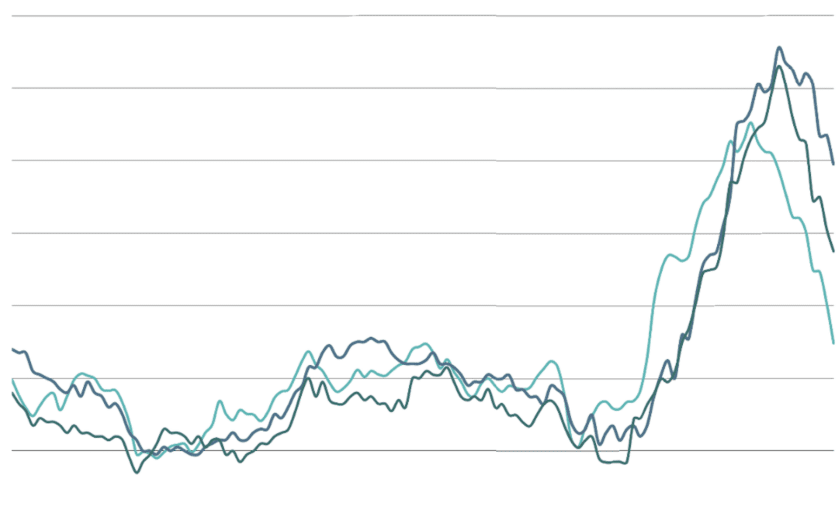

As it transpired and as Figure 1 shows, UK inflation finally surprised to the downside and joins US and European inflation in heading lower. Although with UK CPI running at 7.9% versus 8.7% last month, the bank of England can hardly declare victory given the 2% long term target.

Figure 1: CPI Inflation (%YoY)

Source: Waverton, Bloomberg as at 30.06.23

The market reaction to the UK April CPI numbers focused on the overshoot of headline and core inflation relative to forecasts, ignoring a continued slowdown in headline price momentum. The June data suggested a further decline in six-month momentum to about 5% annualised in July on the way to much lower levels in late 2023. The projection of a fall to 5% or so in July is supported by a bottom-up analysis incorporating the announced 17% cut in the energy price cap that month.

The market reaction tells you all you needs to know about how extreme negative position had become in the ‘basket case UK’ trade. The FTSE 100 rose 2.6%, while the FTSE 250 rallied 5.0% and UK REIT’s shot up a mighty +8.1% on the day, as investors scrambled to cover shorts and heavily oversold positions rallied hard. While mainstream media headlines from the property sector have been and may continue to be poor due to the move higher in bond yields, the threat to further NAV write downs from here is lower given the prospect of lower inflation and thus less pressure on further interest rate rises.

Equally within the listed investment company sector where the market had been ascribing maximum pain for any discount rate sensitivity, while zero value to higher earnings due to the inflation linked nature of many underlying cash flows, there was a sharp reappraisal of fundamentals.

Where to from here?

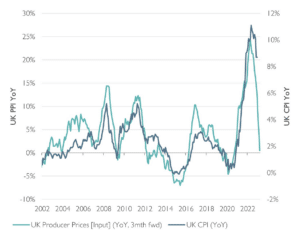

Slow money supply growth (higher rates) and a deflationary impulse from various key global commodity prices are all coming together to drive UK inflation lower, which may result in the rate falling quicker than the consensus over the next few months.

This may be a very positive environment for one section of the market which has faced significant challenges post the Truss / Kwarteng mini-budget in September 2022 and over 2023 to date.

An unprecedented rise in gilt yields, a precipitous decline in sterling, aggressive selling of the FTSE 250 and UK REIT market by passive investors, in conjunction with forced liquidation of assets by pension funds, cumulated in an emergency Bank of England intervention to stabilise the UK government bond market. All as the result of the new Chancellor’s mini-budget statement, delivered on the 23 September. The overall investment trust universe was not immune to the September moves and discounts moved wider across the whole sector, approaching all-time lows akin to 2020 and 2008.

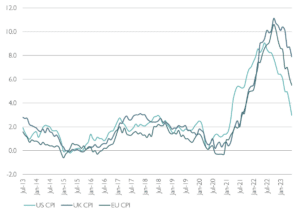

The weak share price performance of the UK listed real assets held in the Waverton Real Assets Fund is highlighted by Figure 2, detailing the derating in share price versus NAV for the listed investment company and REIT exposure within the real assets fund. This aggregate exposure took a further leg down in June as gilt yields rose in response to the higher than expected UK inflation print. There may be further weakness in certain NAV’s across the sector, but we do believe the market has over discounted the potential falls, providing a very attractive opportunity set from here.

Figure 2: Real Assets Fund – Investment Trust performance carve out

Source: Waverton, Morningstar as at 30.06.23

Potential Catalyst for reversal of this trend:

1. Stabilisation in UK rate markets: Alternative investment company share prices have become increasingly correlated (in the short term) to moves in the UK rate market, irrespective of underlying company returns. We believe UK inflation appears to have peaked, and there is the possibility it may fall quite sharply over the next 12 months. This would be a very supportive environment for many listed REITS and investment companies.

Figure 3: UK CPI vs. UK Producer Prices (Input), 3 month forward

Source: UK Office for National Statistics, Bloomberg, Waverton. As at 30.06.23

2. Passive UK equity market redemptions: Can the sentiment to the UK get much worse, a reversal in this trend would be supportive. Signs of crowded FTSE 250 shorts, pessimism overdone?

3. Further M&A in the sector: UK REIT market has witnessed takeover activity, other areas such as renewables and infrastructure may be next targets.

4. Structural discount control mechanisms enacted: Continuation votes, return of capital, buyback. Active board engagement as a shareholder, advising on how discounts can be narrowed.

5. Change in costs and charges disclosure requirements: IA, AIC and HMRC consultation suggest possible change in next 12 months.

We are optimistic for future returns; the investment companies held in the Fund trade at a weighted average discount to NAV of c.11% (an all-time low since the launch of WRAF in November 2018) resulting in an attractive double digit prospective return. ‘What investors should expect’ table at quarter end, highlighted below for reference.

Figure 4: Fund return expectations

Source: Waverton, Morningstar, Bloomberg As at 30.06.23

Ongoing results indicate robust NAV, earnings and dividends, indicative of attractive underlying fundamentals. The underlying portfolio income is supportive for prospective returns – a further quarterly dividend in excess of 1% (4% pa) was paid during Q2.

The Fund appears well positioned with a range of core inflation linked assets across Property and Infrastructure, a combination of direct real asset fixed income holdings and floating rate exposure across Specialist Lending, attractively valued Asset Finance holdings and Commodity exposure, expressed through energy and green metals. Might this single ray of sunshine evolve into a sustained period of sunshine for certain parts of the UK equity market.