The Department for Work and Pensions must take urgent action to resolve ongoing problems around pension transfer regulations, says Quilter, as issues persist.

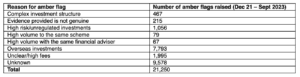

The warning comes after a Freedom of Information request to the Money and Pensions Service showed that more than four out of five (82%) of all amber flags were raised due to either an unknown reason or for a potentially low risk transfer relating to overseas investments.

Of the 21,250 MoneyHelper pensions guidance sessions conducted since the regulations were introduced two years ago, nearly half (45%) were conducted with an attendee who did not know the reason why an amber flag had been raised. Furthermore, more than a third (37%) were conducted after a flag was raised on potentially low-risk transfers relating to overseas investments.

Quilter said a primary issue was the wording around overseas investments, with flags often catching many legitimate investments in overseas markets, resulting in many potentially low-risk pension transfers being halted despite guidance from The Pensions Regulator.

Another issue identified by Quilter was a failure to inform customers why an amber flag has been raised. This has led to difficulties in assessing the effectiveness of the regulations due to gaps in data collection and risks diminishing consumer engagement with the MoneyHelper sessions, the wealth manager said.

Jon Greer, head of retirement policy at Quilter, said: “There is no doubt that the pension transfer regulations will have helped save people from fraud and while it is positive to see such an increase in the number of people receiving scam guidance when there is a real cause for concern, the fact remains that there are far too many unnecessary points of friction within the regulations that have put a dampener on their effectiveness.

“For two years now, the industry has been making the case with the DWP to make meaningful changes to resolve the issues caused by the regulations. Since Quilter’s initial FOI request to MaPS revealed a large number of potentially low risk transfers relating to overseas investments were being needlessly halted, we have continuously called on the DWP to put the issues right. It was hoped that the DWP’s review would resolve the ongoing problems but disappointingly action in this area is slow.”

Greer said there remains a “clear divergence” between policy intention and the practical application of the law when it comes to the wording around overseas investments. Greer urged the DWP to provide clarity to the way rules are worded to make a distinction between overseas investments that present a scam risk and those that do not.

Greer also warned that the lack of clarity to consumers increases the potential for further consumer disengagement and frustration.

Greer added: “The onus must be put on pension schemes to provide clear and accurate information to customers on the reason an amber flag has been raised and making it an explicit legislative requirement would be a sure fire wag to solve the issue.

“In its review, the DWP committed to conducting further work and considering making changes to improve the pension transfer experience. It must now look to resolve these issues as a matter of urgency as consumers are needlessly suffering delays and have been for two years.”