People who inherit a pension pot could be hit with a new ‘death tax’ if the Treasury’s latest proposals are successful.

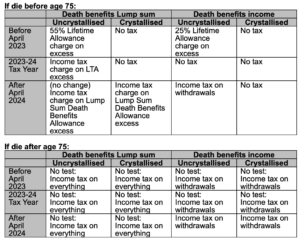

Under current rules, when somebody dies before turning 75, their beneficiaries can inherit their defined contribution pension completely tax-free if it is under the lifetime allowance. However, in a new consultation, the Treasury has said it is considering applying income tax on beneficiaries’ ongoing withdrawals made from pension pots from April 2024. By contrast, if the same person took the inherited pension as a lump sum and it was within their £1,073,100 limit, it would remain tax free. Any excess over the limit would be taxed in the same way as income.

The proposals follow Chancellor Jeremy Hunt’s decision to scrap the lifetime allowance from April 2023.

The Treasury is now attempting to fulfil the chancellor’s promise but its proposals are “arguably more complex” than the old lifetime allowance rules, warns pension specialist AJ Bell.

The government has proposed creating two new lifetime limits to replace the lifetime allowance: a ‘Lump Sum Allowance’ of £268,275 and a ‘Lump Sum and Death Benefit Allowance’ of £1,073,100. This lump sum limit will only apply to lump sums taken in life and paid out on death, with no similar test proposed for income payments. Instead, the Treasury is planning to charge income tax on untouched pensions inherited as income – creating a new ‘death tax’ on pensions.

The implications of the proposed rules are still being assessed but the shift in approach on death, if adopted, would be the most significant change, says AJ Bell head of retirement policy Tom Selby.

“The decision to scrap the lifetime allowance had the potential to be a hugely positive step in making pensions simpler for millions of people and ditching a significant disincentive to save for their financial future. It will still provide a big boost for pension savers, however the government is at risk of tying itself in knots by creating two new lifetime limits for pensions.

“But, bizarrely, not content with this confusion, the government is considering going further and adding complexity to the new rules by creating a new pension ‘death tax’ where someone dies before age 75. Creating a tax on death in this way makes little sense and may push more beneficiaries to take a lump sum when an income is more suitable for their needs or encouraging the member to take their pension benefits earlier than planned to avoid their loved ones paying income tax. It also risks causing a political firestorm for the government and undoes much of the simplification benefits associated with ditching the lifetime allowance.”

The rules are still to be finalised in legislation and AJ Bell has called for urgent clarification so that pension savers “can make informed decisions based on the planned rules, albeit those rules could yet be re-written if a future government changes pension legislation again.”

The Labour party has vowed to reverse the LTA changes introduced by the current government if elected at the next general election. However, it remains uncertain whether the party would introduce other reforms to compensate.

Natalie Kempster, head of Client & Proposition at Argentis Wealth Management, says the changes could force more people to take out a lump sum. As an example, she says: “A spouse may no longer be able to step into the shoes of their deceased partner and continue to receive a drawdown income. Instead, Kempster believes they may now be better off taking a lump sum and reinvesting it, with all the associated costs involved.

Kempster believes smaller savers are likely to be worst hit. “Those without the resources to pay for financial advice may either inadvertently pay tax when they don’t need to, or they could fail to look after the cash lump sum, which is later needed to fund their own retirement as a widow/er.

The bigger impact, she says, “is a continued lack of trust in financial services and pensions, where the rules are not only complex, but also subject to change.”

AJ Bell also gives this example of how the proposals might work: Susan built up a SIPP fund of £500,000. She has not yet taken benefits. She dies aged 68. Her husband John chooses to take the pension benefits as a drawdown income. He already receives a private pension and a state pension taking his income over the higher rate threshold.

If Susan dies in March 2024, John won’t pay any pay income tax on any of the payments from Susan’s old pension. However, if she dies after 6 April 2024, John will have to pay 40% income tax on all his drawdown withdrawals.

If John takes £25,000 a year, increasing each year by 2%, then after 17 years he will have paid over £200,000 in income tax, based on today’s tax rates and thresholds.

Source: AJ Bell