In her last article of the year looking at fund or fund managers hitting a three year track record, Juliet Schooling Latter, research director, FundCalibre, talked to Nick Clay, manager of the TM Redwheel Global Equity Income fund.

No industry loves an acronym quite like the investment world – GAMMA, FAANG, BRICs and TINA all come to mind when I think of catchy names which have dictated asset flows.

But this year we’ve gone full FOMO (fear of missing out) on the ‘Magnificent Seven’ tech companies (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla) – all of which have dominated the equities landscape in 2023.

Already market leaders, many have been bolstered by the Artificial Intelligence (AI) theme in the past 12 months. But the worry is these companies are now trading at incredibly lofty valuations – to the point where investors expect growth in any scenario. To put this into context, at the start of September 2023, the Magnificent Seven were trading on an average P/E of around 50x, compared to less than 20x for the MSCI World*.

Such narrow leadership is not helped by the significant number of pressures faced by markets in 2023. Inflation, war, and the ongoing uncertainty surrounding the second largest global economy all come to mind.

“Like the realisation that often dawns on every superhero, with great power comes great responsibility; for the Magnificent Seven, they can easily manage to carry the market when sentiment and central banks are conducive. Yet, with history often repeating itself, we have seen time and time again what can happen when this is not the case and when the ending is much less auspicious.”

That’s the view of Nick Clay, manager of the TM Red wheel Global Equity Income fund, who believes there is simply no scope for holding these stocks at these valuations*. Clay heads up the team of four which joined en-masse in 2020 from Newton Investment Management, where they managed the BNY Global Equity Income fund. Nick was at Newton for over 20 years, managing the Global Equity Income fund since 2012

Nick and the team focus on three things when they consider adding a holding to this fund: finding sustainable business models, at good valuations, and trading them with a strong buy/sell discipline. Each of these approaches are common in isolation, but rarely are all three together.

In order to find these ideas, the managers have an overriding philosophy to “buy the controversy and sell the consensus”. This means the fund has a contrarian approach. To find these controversies, they look for multiple types of ideas. These are categorised as ‘troubled compounding machines’, where temporary problems for a business are being mistaken for permanent issues; ‘ex-growth cash generators’, where the market believes a business is broken but is able to create longevity of returns; ‘profitability transformation’, where there are fears over a company’s exposure to the economic cycle; ‘capital intensity’, where the market is bored of a stock or underestimates its compounding power; and special situations such as spin offs or hidden assets.

The total portfolio will be just 40-60 stocks, each yielding 25 per cent above the market at the point of purchase.

Clay says while income investing is often associated with defensive areas of the market – it is not completely cut off from growth orientated markets, provided they have a premium yield with sustainable cash flows. A good example is Taiwan Semiconductor Manufacturing Company (TSMC), which also has the tools to benefit from the drive in AI.

“Compared to its closest Magnificent Seven relative, Nvidia, TSMC has a much more palatable valuation: it trades at a P/E of 16x,” he adds.

A good example of the team “buying the controversy and selling the consensus” was the impact of the Chinese shutdown on luxury retail sales in early 2022. Clay says the probability was that China would not be in lockdown forever and that they could model what those companies might do when the economy re-opened.

He says: “Given that you’ve got the evidence of what happened when the West reopened it showed the risk/reward in the valuation of the stocks at that point was skewed towards the upside.”

The focus on buying things on the downside has also proved useful in allowing the fund to perform in volatile markets. This is because a lot of the bad news is already in the price of these out of favour companies, so when things do go wrong in the market they tend not to fall to the same degree.

But back to FOMO, which Clays says alongside benchmark risk – are prompting allocations to growth more widely*.

He says: “Over the years, we have built up a bank of lessons to draw from, including avoiding parts of the market statistically difficult to repeatedly succeed in, which becomes particularly eminent as volatility increases. These narrow rallies are some of such cases, and there will rarely be scope for index behemoths to creep into the portfolio, due to our yield and valuation discipline. This may seem painful, but we believe it is a case of short-term pain, long-term gain; we are not looking to chase returns, but to cultivate them in a sustainable manner by harnessing the statistical power of dividends supported by quality business models.”

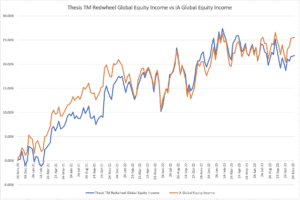

This fund has a true contrarian nature, backed up by an experienced team with a logical and disciplined philosophy. This leads to an attractively yielding income fund that also allows for capital return from a concentrated portfolio. It makes it a core consideration for anyone looking for global income opportunities.

*Source: Redwheel, 13 September 2023

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.