For this month’s three-year track record article, Juliet Schooling Latter, research director, FundCalibre, looks at the IFSL Marlborough Global Innovation.

There is no doubt technology is shaping our lives at an unprecedented rate. How we work, communicate, entertain, and manage our day has changed significantly in the past decade alone.

But it is more than just hardware and software driving this change. Yes, silicon chips play a major role, but there are plenty of innovators across sectors using this technology to their advantage. This can be through developing new technology; using technology in original ways; and generating new ideas in high growth areas.

“The pace of change is the fastest we’ve seen in human history. It took 150 years to get flushing toilets to 80-90 per cent of US households. Only 4 per cent of US households had a tablet computer in 2010 – seven years later nearly two-thirds did.”

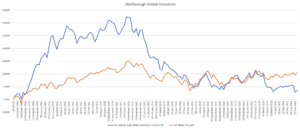

That’s the view of IFSL Marlborough Global Innovation fund manager Guy Feld, who says the pace of disruption across the likes of smartphones, the internet, crypto, e-commerce and other areas like water purification, is growing rapidly. Guy took over this fund in October 2020 – when it was a global technology vehicle – before rebranding it a year later.

The fund now has a heavy weight to technology firms, but it will invest in innovative disruptive companies from any sector. The fund can invest globally, but most of the investments are in the US or the UK, with at least 50 per cent in small caps.

Guy is a pure stock picker – with an exceptional network of contacts – he gets information from a wide array of different sources to build up a mosaic picture of what is happening with companies on the ground. The team targets long-term investment themes including digitisation of media, cybersecurity, fraud detection, digital payments, water conservation, US online gambling markets, hybrid cloud services, automation, and radio frequency technology.

Upon taking over the mandate, Guy made wholesale changes – keeping only 2-3 of the existing holdings as he sought to adapt the portfolio to the broader mandate, with a number of larger/more liquid holdings coming in.

There are now plenty of examples of investing beyond the pure tech play. For example, water infrastructure and purification business Xylem and MYR Group, an electrical contractor in the US, which is a play on data centres, renewables, battery storage and electrical vehicles.

Another is Tonies, the company behind the Audio Toniebox. “Why are we getting involved with a toy company? Essentially they’ve created their own little company, whereby it is a screenless toy, but fully interactive. Children can learn and hear stories via these figurines. If your child likes it, they want more figurines, you download more stories and it becomes an emerging revenue line for this business to limit screen time,” he says.

But the fund is not immune to the current challenges in markets. Guy is refreshingly honest when he says smaller companies simply cannot “roll with the punches” – adding that with concentrated customer bases, firms are exposed to the mega-tech companies which are making cuts like never before.

He says: “Some of my holdings have sensitive profit and loss to that. The liquidity challenges compound the damage. But we still believe these companies are good at what they do, and they’ll come out the other side – assuming they do not have too much debt.”

However, Guy freely admits this is the most challenging market he has seen in thirty-year plus career. He is cautious about markets and has a healthy cash allocation of 12 per cent.

“Not everything is screaming cheap – people are confusing low multiples with being cheap, they can also be value traps. But I do think there are cracking companies around – and good companies will always get finance,” he adds.

Turnover on the fund has been around 50 per cent, although it should be noted that Guy does run his winners – while the fund has also been the benefactor of some seven companies being the subject of M&A activity.

The important thing to remember is this pace of innovation is unlikely to slow down. Guy believes Artificial Intelligence will be as common as mobile phones in the future (it will be everywhere) while threats like cyber security will only grow and need more solutions to tackle this challenge.

Another good example in the portfolio is Acusensus, an Australian firm which provides automated recognition of drivers using mobile phones when driving. The firm was founded in 2018 by Alexander Jannink and Ravin Mirchandani, the former was inspired to do so after a friend riding a bicycle was killed by a driver who was allegedly driving drunk and using a cell phone. There is huge social pressure to get the technology, with pilots taking place in the UK and Canada (in addition to Australia).

Guy believes now presents an interesting opportunity for investors. Why? Because although there is little certainty on markets – there is far more on the rate of change taking place. He believes there are so many disruptors and while tech-related activities are already deeply embedded in our lives, it will only grow from here.

Guy’s track record is too good to ignore, and we are excited about the prospects for this revamped fund. It has had some significant headwinds, but we feel investors should consider the rewards of investing in disruptor companies tapping into significant societal changes in the long-term.

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.