Homeowners who boost their pension contributions after paying off their mortgage could see an extra £52,000 in retirement income, new analysis from Standard Life has revealed.

While sharp interest rate rises over the last year have led to many homeowners seeking longer mortgage terms in an attempt to help their monthly budgets, Standard Life said paying off a mortgage as early as possible would not only remove the need to factor housing costs into retirement planning, but could see pensioners boost their retirement pot.

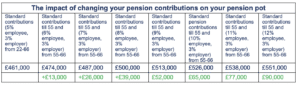

Standard Life’s analysis shows that those who begin working on a salary of £25,000 per year and pay the standard monthly auto-enrolment contributions from the age of 22 could build up a total retirement fund of £461,000 by the age of 66*. However, topping up contributions by 4% for ten years from the age of 55, the age at which a 25-year mortgage term taken out at age 30 would be paid off, could result in a total pot of £513,000 – an increase of £52,000.

The group said the potential of late-career compound investment growth has the potential to boost growth even further. For example, someone saving into a pension from age 22 at standard monthly rates could have a pot of £228,000 by the age of 55. Continuing contributions at standard rates for an additional decade, until age 66, could add an extra £233,000 to the pension pot.

Dean Butler, managing director for retail direct at Standard Life, said: “Interest rates have rocketed since the middle of last year and so it’s understandable that people are looking for longer mortgage terms to ease the monthly strain. It won’t be possible, or even sensible, for everyone to stick to a shorter mortgage term, however it’s worth considering the potential retirement impact of any decision. There are obvious benefits to being mortgage free in retirement itself, but additionally having the option to swap mortgage payments for pension contributions in those valuable years leading up to retirement can have a significantly positive impact on your pot, and as a result on your standard of living in retirement.”

*if beginning working with a salary of £25,000 per year and paying monthly contributions into a workplace pension at the age of 22, assuming 3.5% salary growth per year, 5% a year investment growth and a 0.75% annual charge.