Future generations are shifting the retirement trends, Standard Life analysis has revealed, with Gen Z, for instance, taking a more realistic view of their retirement prospects.

In the journey towards retirement, Gen Z is charting a different course, aiming for part-time work or self-employment rather than a sudden halt to their careers. According to recent research from Standard Life, a significant portion of Gen Z plans to transition to part-time work (47%) or venture into self-employment (22%) as they approach retirement age.

Contrary to this intention, current retirees mostly chose to cease working entirely upon retirement, with 76% opting for a complete stoppage of work rather than a phased approach. Only a minority (17%), opted for part-time work, while a mere 3% ventured into entrepreneurship before retiring fully.

Dean Butler, managing director for Retail at Standard Life, commented on this shifting mindset: “Younger generations are looking at retirement in a very different way and see it as more of a phased run-in to eventually stopping work. While their attitudes may change over time, this pattern makes a lot of sense given longer lives and changes in working habits.

“It does of course come with its own challenges and relies both on people finding the right employment opportunities and being in good enough health to take advantage of them.”

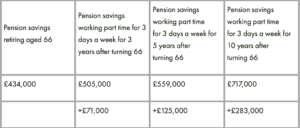

Standard Life’s analysis underscores the potential benefits of extending one’s working life, particularly through part-time employment post-retirement age. For instance, a hypothetical scenario involving a £25,000 annual salary with minimum auto-enrolment contributions could yield a retirement fund of £434,000 by age 66. However, opting for part-time work for just three days a week over three additional years could potentially add £71,000 to an individual’s pension pot, assuming the pension remains untouched.

Dean Butler emphasised the significance of this approach, stating, “If you’re able to continue working and not touch your pension for a number of years, the effects of further contributions and compound investment growth can really add up.”

As younger generations prepare for retirement, the idea of phased retirement supported by part-time work emerges as a strategic avenue for enhancing retirement savings, offering a promising alternative to the traditional notion of abrupt cessation of work.

Note to table: If beginning work with a salary of £25,000 per year and paying 5% monthly employee contributions and 3% employer contributions into a workplace pension at the age of 22 and assuming 3.5% salary growth per year. Figures are not reduced to take effect of inflation. Annual Management Charge of 1.00% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.