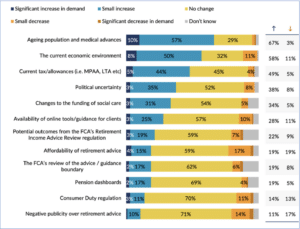

The retirement advice market is shifting, driven by an ageing population and medical advances, according to a new report from NextWealth analysing the drivers of demand for advice.

The report, sponsored by Aegon, found more than two thirds (67%) of advisers cited people living longer as changing the demand for retirement advice.

The ongoing cost-of-living crisis, alongside higher interest rates and volatile markets, also continues to impact demand, with 58% of advisers expecting the economic environment to prompt clients to seek financial advice.

This was followed by current pensions and tax rules and allowances, including the abolition of the Lifetime Allowance and increases in annual allowance rules, with nearly half (49%) of advisers seeing increased demand from clients affected. Political uncertainty was also a factor for 38% of advisers.

Steven Cameron, pensions director at Aegon, said: “Once again, this year’s report from NextWealth highlights the importance and vibrancy of the retirement advice market, with many factors contributing to healthy demand. People are on average living longer and having to bear more of their own financial risks in a defined contribution world, which means that making informed retirement decisions has never been more important or personal to each individual.

“Other key drivers are the current economic climate, and recent changes to pension tax rules and annual allowances. These are creating real pressure to advise affected clients.”

However, amid the upsurge in demand, NextWealth and Aegon said concerns linger. Affordability remains a barrier to retirement advice, while advisers also expressed concern about the impact of regulatory change such as Consumer Duty on demand for advice.

“While the Consumer Duty may be adding new considerations to the provision of advice, we hope that longer term it will further improve confidence amongst consumers that the advice they are receiving is of consistently good value,” added Cameron.

Heather Hopkins, managing director of NextWealth, commented: “While demand for retirement advice remains strong, there are challenges on the horizon. Concerns about the affordability of financial advice for those who need it most weigh on the minds of many advisers. Negative publicity further clouds the landscape, and the ever-shifting regulatory environment adds complexity and cost. This report, kindly sponsored by Aegon, is a testament to the evolving landscape of retirement advice.”

Chart: Drivers of demand for advice