Financial strength and sustainability are now of even greater importance in platform due diligence for advice firms and would lead them to switch platforms, new research has revealed.

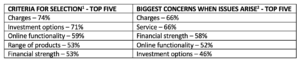

The Guide from AKG shows that advice firms are likely to have been using their chosen platforms for some time and selected them based on three main factors – charges, investment options and online functionality – with financial strength further down the list.

But the latest data shows that the importance of financial strength/sustainability has increased this year when firms were asked what items they consider when conducting platform due diligence and the factors that would make them switch platform.

Some 58% of advisers said they would consider moving platforms over explicit concerns about financial strength. It now ranks third in the areas of concern when issue arise with platforms being used (see table below), directly behind charges and service.

Commenting on the greater emphasis on financial strength, Jon Baker of Jon Baker Consulting said: “In my role as a due diligence consultant to advisers, I see a wide variety of approaches to assessing platforms. It is interesting that advisers do not rate financial strength as the top consideration when selecting a platform. Maybe they assume that because the platform is an enabler and the assets are ring-fenced if things go wrong, that clients won’t directly lose money if a platform fails. However, clients will inevitably panic if they can’t view or withdraw their money. Choosing a platform with questionable financial strength is not a client relationship risk that advisers need to face.”

Matt Ward, communications director at AKG, said the 23-page AKG guide, which is sponsored by Aegon and free to download from the AKG website, had been designed to provide practical support for advice firms in respect of the “core approaches and key elements that advisers should have in mind when preparing a framework to conduct due diligence.”

Matt Ward, communications director at AKG, said the 23-page AKG guide, which is sponsored by Aegon and free to download from the AKG website, had been designed to provide practical support for advice firms in respect of the “core approaches and key elements that advisers should have in mind when preparing a framework to conduct due diligence.”

The three key due diligence areas for consideration when selecting and re-appraising platform partners, covered by the guide are: Proposition; Operations; Strength and sustainability.

The guide was begun pre the Coronavirus pandemic so did not set out to chart its impact but the data reflects to some effect how it has changed priorities for advice firms, “effectively serving to exacerbate and/or accelerate some of the momentum challenges for platform operators”, AKG says.

“Platform impairment or failure is not just a hypothetical risk. And adviser research carried out for this project reinforces the importance of considering platform operator financial strength and sustainability in selection/retention processes.

“There is a need for a broad criteria consideration and context within financial strength assessment – with a broad base of strength required to deal with even unknown stresses, as well as those that can or have been modelled.”

Financial strength warning signs

AKG’s approach to and definition of financial strength is to consider a company’s strength to sustain an operation and continue to meet the needs of customers and their advisers.

The guide flags a variety of warning signs which may indicate a business is experiencing challenges with its financial strength and sustainability and/or operational capability and resilience, including:

• Lack of transparency in reporting of key financial data/metrics

• Indifferent performance against key financial data/metrics

• Parental indifference to operational subsidiary

• Lack of access to development capital

• Inability to raise investment funds

• Operational cost cutting which might include organisational restructuring, office closure or staff redundancies

• Abrupt changes in strategic direction or corporate restructuring

• Raft of senior management departures

• Inability to complete operational or strategic development projects

• Operational systems and/or servicing difficulties

• Sluggish response to key regulatory changes

• Subject of specific, individual regulatory scrutiny and/or fines

AKG commented these are areas which “might cause concerns” more likely in combination than in isolation.

1“What were the most important selection criteria when you selected your existing platform partner(s)?” – Respondents were asked to select their top five reasons from a list of options;

2”Should you see deficiencies in, or experience difficulties with, any of the factors listed, which would cause you most concern and encourage consideration of platform switching?” – Respondents were asked to select their top five reasons from a list of options