Sponsored article.

Amidst all the brouhaha related to the impact of pension tax charges on clinicians’ retirement plans, you’d be forgiven for missing a government consultation on proposals to change NHS pension scheme contribution rates for members in England & Wales (NHSPS), says Moira Warner, Senior Intermediary Development and Technical Manager, Royal London.

This consultation, which closed on 7th January 2022, is significant because it aims to share the costs and benefits of the Scheme “more evenly” and in so doing, it proposes, inter alia, that the contribution rate for more than ½ million of the lowest NHS earners will increase, whilst the rate for those with the highest earnings will decrease.

Although increasing contribution rates for those with the lowest earnings may seem counter-intuitive to full scheme participation, there is some logic to this measure. The tiered contribution rates currently in force, and which were introduced in the noughties, were designed to reflect that higher earners received proportionately better benefits under a final salary scheme. But as all scheme members, regardless of age, will accrue Career Average Revalued Earnings (CARE) scheme benefits from 1 April 2022, this advantage largely disappears. So an adjustment to member contribution rates is considered necessary.

Additionally, the government proposes that contribution rates will be determined by reference to the individual’s actual pay rather than their whole-time equivalent (WTE), so those falling into one of the lower contribution tiers by virtue of being a part-timer, may not have to pay more in £s and pence notwithstanding the increase in rates.

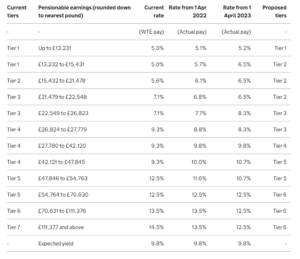

The main proposals are outlined below.

Reduction in the number of contribution rate tiers:

A reduction from 12 to 6 wider contribution tiers, reflective of the fact that all members get the same proportional benefit under a CARE scheme.

Source: NHS Pensions Scheme: Proposed Changes to member contributions from 1 April 2022

Visit Royal London’s tax year end hub

Contribution rates to be based on actual pay

The change to determine contribution rates by actual pay earned rather than WTE is a significant positive for part-timers. For example, under the current structure, a scheme member on a WTE salary of £26,000 p.a. but working 50% hours so actually earning £13,000 p.a., would pay a contribution rate based on earnings of £26,000. This change would result in a contribution rate of 5.2% rather than the 8.3% which would otherwise apply from April 2023.

Tier boundaries to increase in line with annual AfC pay awards

A further proposal involves increasing contribution tiers in line with AfC pay awards. This aims to remove situations where incremental pay awards tip a scheme member into a higher tier, with a higher contribution rate, which can result in a pay increase perversely reducing take-home pay.

Phasing in of new contribution rates

It is proposed that the changes to the member contribution structure will be phased in over two scheme years commencing 1st April 2022. Rationale for this is to reduce immediate impacts on take-home pay for those who’ll be asked to pay more and hence minimise the risk of opt-outs. It’s worth noting that these increases for lower earners aren’t timed to coincide with measures announced by government to address the great net pay anomaly for lower earners. So the higher contribution rates will kick in from 2022/23, but tax relief for those earning less than the personal allowance won’t be available until 2024/25.

Comment and Summary

Many commentators will agree that there’s a case for change. Other public service pension schemes such as the Teachers’ schemes and the Local Government Pension scheme moved to a contribution structure based on actual pay rather than WTE when their respective CARE schemes were first introduced. And in most, the contribution rate structure is flatter than that which currently applies in the NHSPS. But it feels instinctively questionable when those with the highest incomes will be asked to pay less at the expense of those on the very lowest incomes in order to maintain the overall member contribution yield of 9.8%. Let’s hope it doesn’t result in an increased rate of affordability opt-outs.

Advisers and paraplanners grappling with Annual Allowance issues for NHS clinicians will be interested to hear that there’s more related good news for the very highest NHS earners. Reduced contribution rates where applicable will alter the cost/benefit dynamic of scheme membership as reduced member contributions equate to reduced costs. As outlined in the Royal London adviser policy paper, “Why paying a tax charge isn’t always a bad thing”, one test of the suitability of opting out is whether the member’s net benefits in a given year, exceed their net costs (ie tax charge + net contribution). For a lucky few, this changed dynamic will improve the argument for remaining in the pension scheme.