Henk-Jan Rikkerink, Fidelity’s Global Head of Solutions and Multi Asset, discusses why he expects growth to be solid and earnings respectable this year, barring major catastrophe. However, growth momentum is slowing, while valuations and positioning give cause for concern.

Fidelity’s Global Macro team, whose views are a key input in our asset allocation decisions, have highlighted increased risks from policy uncertainty, stickier inflation, and the slowdown in China. Weighing this all up, we begin 2022 with a neutral view on equities. We expect volatility to increase in the near term and are watching for clarity around the macro situation or oversold market signals to change our view.

Vaccines drive performance

Within regions, we expect developed market equities to continue their recent outperformance in 2022, largely due to lower vaccination rates and tightening monetary policy in emerging markets. We expect the US to perform strongly, especially in the event of equity market volatility, due to its defensive nature, supportive monetary and fiscal policy, and strong earnings. Japan too looks well placed to have a good year as vaccination rates pick up. We are more cautious about the outlook for Asia excluding Japan. China is the elephant in the room and reading the tea leaves on the policy path from here is difficult.

Challenging outlook for US Treasuries

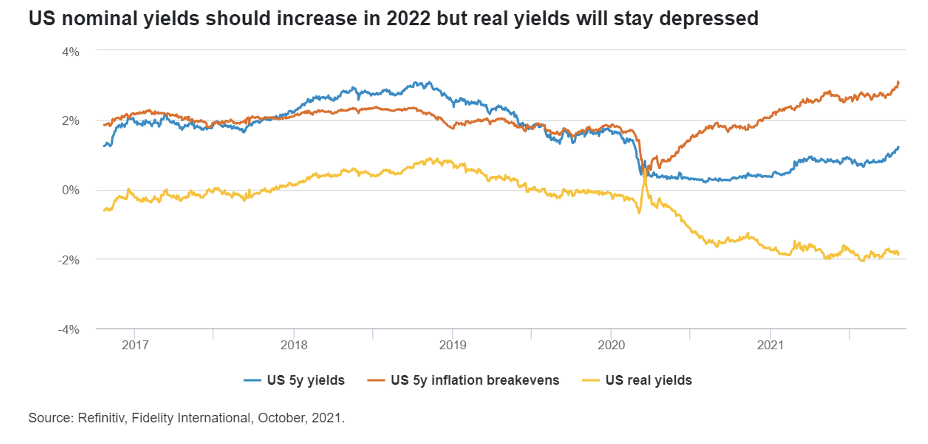

In fixed income, we expect US nominal (but not real) yields to increase in 2022, due to the Federal Reserve tapering asset purchases and higher inflation prints, making the outlook for US government bonds challenging. We are more positive about the outlook for UK gilts – we think the Bank of England’s hawkish rhetoric is a mistake and that higher yields and steeper curves will have a negative impact on an economy already under stress from higher prices. The end of the furlough scheme could also hurt the labour market. Either the Bank of England will be forced to back down, or slower growth from higher rates will feed into gilts and flatten curves.

Defaults should remain low

In credit markets, investment grade bonds are currently less attractive on a total return basis. Spreads are tight and total returns are low, and we see little sign they will improve any time soon. Fundamentals are also weak compared to history. Even if they do improve, this would be offset by a deterioration of credit quality, in our view.

In high yield, defaults should remain exceptionally low. Liquidity is still plentiful and the demand for yield is strong – supportive factors that we expect to continue. Some specific sectors offer value, such as energy, and spreads may compress further from here. The asset class’s lower interest rate sensitivity is also appealing in an environment where government bond yields may rise.

The team takes a positive view of the US dollar in 2022 for its defensive properties, as well as the backdrop of fiscal spending, Fed tapering and slowing growth in China. However, we expect the euro to perform relatively worse – there is less scope for rates rises at the European Central Bank this year.

Alternatives may offer defensive option

There is uncertainty in the air as we head into 2022. Given the team’s view that real rates will remain very low throughout the year, and therefore government bonds will perform poorly, alternatives continue to be an attractive option for defensiveness in multi asset portfolios, especially renewable energy projects given the recent energy market ructions. They often come with index-linked contractual cash flows that are less correlated to equities and bonds.

Global Asset Allocation Insights

You can access the monthly update from Fidelity Multi Asset on the areas of the investment universe which are presenting the greatest opportunities and risks.

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Investments in emerging markets may be more volatile than other more developed markets. Changes in currency exchange rates may affect the value of investments in overseas markets. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Due to the greater possibility of default, an investment in a corporate bond is generally less secure than an investment in government bonds. Sub-investment grade bonds are considered riskier bonds. They have an increased risk of default which could affect both income and the capital value of the fund investing in them. Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority and Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0121/370185/SSO/NA