Bevan Blair, chief investment officer at One Four Nine Portfolio Management, comments on recent market movements

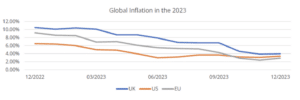

After a series of global rate hikes by central banks across Europe, the US and the UK, there has been a welcome decline in inflation across the board. Given this, we now believe that we are at the end of the current rate rising cycle. The path to the Bank of England’s target inflation of 2% will be rocky but given the weakness of demand in the economy with wage push factors dissipating we cannot see where policymakers would want or have room to further increase interest rates. In addition, given the conflicting schools of thought on whether the UK entered either a technical recession or experienced stagflation at the end of 2023, the impetus to further depress consumer demand with higher rates would further exacerbate issues.

We don’t however feel that rate cuts are just around the corner, with reductions more likely in the second half of 2024 once central banks are confident that inflation has been tamed, making it safer to initiate monetary easing. Once reductions begin, it is unlikely we will see rates head back to record lows. Central banks will want to keep some rate powder dry for the next existential crisis they may face, and we believe this rate easing cycle will be shallower than previous cycles.

Overall, we expect the US to be the first central bank to move on rates with the BOE and ECB following suit, but not immediately. The ECB President Christine Lagarde has already said as much suggesting that the first rate cuts may not come until the summer.

Market performance

Markets reacted to softening inflation and increasing dovish tones from central bankers regarding weights by rallying in the last two months of 2023. This turned what was looking like a flat year for returns into a year where good money was made across most asset classes and sectors, masking weak performance.

Gilt yields

In the UK the 10-year Gilt yield fell from 4.44% at the end of September to 3.54% by the end of the year. The falls in yields were similar across the yield curve as the 30-year yield fell 76 basis points from 4.9% to 4.14% and the 2-year yields fell 93 basis points from 4.91% to 3.98%. Only at the very short end, three months, did yields remain relatively static with the three month yield only falling from 5.44% to 5.29%. The falls were driven by longer expectations of rate cuts, whereas the market continued to discount rate cuts in the near term.

Equities

Equities rebounded strongly as the cost of capital fell with lower yields. Global equities gained 6.7% in Sterling terms over the quarter with growth stocks (+8.5%) and quality stocks (+7.7%) leading the way outperforming value stocks (+4.7%). Almost all regions and sectors provided positive performance over the quarter, but again there was significant differentiation.

Europe was the best performing region gaining 7.6% in Sterling terms followed closely by the US which gained 7.1%. the UK returned just 3.2% lagging behind yet again. Positive returns were also to be found in Japan (+3.6%), Asia Pacific (+3.3%) and emerging markets (+3.3%). Returns were driven more by the expansion of valuations than by an increase in fundamental earnings.

The best-performing region was Japan with a total return of 28.6%, and a dividend of 2.1%. Once we adjust for dividends and inflation the real capital return from Japan was 21.,4%, of which 13.4% was due to expanding valuations and 8.1% from increased earnings. In contrast, the US delivered a similar total return and real capital return, but it was entirely driven by increased valuations. In fact, in the US real earnings were negative over the year contributing -4.3% to returns.

In the UK, returns were much lower and real capital returns were actually negative. The UK also experienced some valuation expansion, although nowhere on the scale of the US, but suffered negative earnings in line with the US.

Finally, both Asia Pacific and Emerging markets suffered significant retrenchment of returns over the year with expanding valuations! A worrying sign that makes us cautious about the outlook for equities in 2024 as we look to see if earnings can rebound to fill the valuation void that has opened within equities. If not, then prices will have to readjust downwards to bring back valuations to more sensible levels, especially in the US.

All investment views are presented for information only and are not a personal recommendation to buy or sell. Past performance is not a reliable indicator of future returns, investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.