Investors should focus on long-term thematic drivers of growth during periods of market sell-offs, says J O Hambro Capital Management.

According to the asset management company, investors should fight their natural instinct to focus on short-term negative noise and instead, model scenarios for companies using long-term timeframes.

As part of a “well established investment process”, investors should employ a valuation control and use the same discount rate throughout the cycle to help identify buy signals when the sales are on.

The firm said: “The past few months have seen darkening economic skies, reflected in some less than pleasant equity market returns. It is at moments like this that investors need to focus on long-term thematic drivers of growth, along with disciplines around balance sheet leverage and valuation to help ensure their portfolios have suitably resilient characteristics.”

As real incomes are squeezed and social unrest builds, J O Hambro Capital Management said the areas of strongest spend are likely to be those which are essential to social stability.

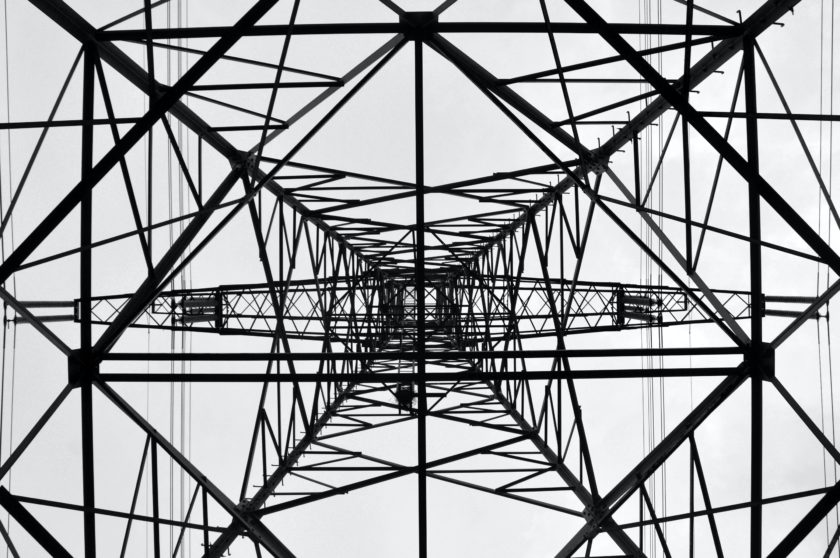

Governments and businesses will need to spend more on re-shoring production and the capex spend linked to this will benefit companies servicing infrastructure projects, while the crisis in energy will see an acceleration in spend both to ensure oil and gas supply as well as build out increased renewables and nuclear capacity, the company said.

Finally, companies in the recruitment sector are likely to benefit from wage inflation, while healthcare is another area where spend is likely to increase as populations grow older.