Tech stocks and funds have dominated the ISA buys for March on the Hargreaves Lansdown platform. Emma Wall, head of investment analysis and research, Hargreaves Lansdown comments.

The end of the tax year is fast approaching, and investors are squirreling away their ISA allowance before the April 5 deadline. There is always a last-minute surge in ISA investments – it’s a ‘use it or lose it’ tax-efficient allowance after all.

This year, last-minute trades have been dominated by those areas that have driven stock market returns over the last year, namely tech stocks.

In the most bought funds, specialist technology and growth-biased equity funds alongside those markets such as the US which have a heavy weighting to tech stocks all feature.

There is some welcome diversification in the form of global income and a European tracker.

Investors should be wary of over-concentration in their portfolios, buying themes and trends that they may already have a sizable exposure to thanks to recent performance.

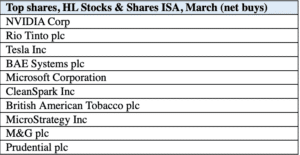

The stock buys paint a similar picture – AI excitement continues to drive interest in chips, with NVIDIA the most bought company in March to date.

Stock selectors are more diversified in their interests than fund investors however, as alongside tech selections some FTSE stalwarts make the top 10 including a tobacco giant and defence company.

This serves as a reminder that geopolitical tensions can drive investment interest, and that a well-covered dividend is difficult to beat.