Hargreaves Lansdown reports a 30.9% increase in investors maxing out their ISA in the early days of the new tax year.

The platform’s clients paying into their stocks and shares ISA in the first 10 days of tax year has increased 10%, with early investors primarily buying US, India, banks and tech investments.

Emma Wall, head of investment analysis and research, Hargreaves Lansdown, puts this down to investor confidence, “which is clearly alive and kicking”.

She says: “While the cost-of-living crisis continues to bite, early bird stats show investors are prioritising making their savings as tax efficient as possible. HL has seen a big jump in the number of early bird savers maxing out their ISA allowance using the stocks and shares wrapper.”

Male investors have made up the bulk of these early birds, she added, with the gender split of the ‘ISA maxers’ in the tax year so far being 67% male and 33% female. “This is a higher proportion of male investors than usual; the HL stock and shares ISA split overall is 61.5% male and 38.5% female, implying our ISA maxer early birds are more male than the general ISA population.”

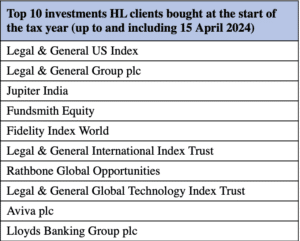

Commenting on what investors been buying, Wall says: “It is a continuation of trading trends we have seen over recent months; the US, India, banks and technology stocks. A mix of momentum and income.

“This is a more diversified list than through 2023, in which just tech dominated the top 10 buys lists, and for an ISA wrapper, which we typically consider an investment timeframe of 5-10 years, these are suitable selections.

“However, investors should consider the correlation between some of these selections and ensure that by buying into areas of the market that have done well they may be increasing portfolio biases.”