With compelling valuations and strengthening fundamentals, frontier markets are starting to move back onto asset allocators’ radars as the external backdrop improves, says Ninety One’s Emerging Markets Fixed Income portfolio manager Thys Louw. But he warns that careful navigation is key but sees the potential rewards as substantial.

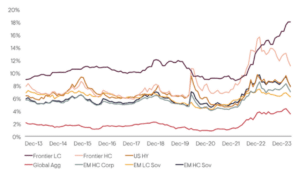

With a market cap of over US$1.4 trillion – similar in size to the c.US$1.2 trillion US high-yield market – comprising 50 liquid investable markets and with daily turnover of c.US$2 billion, the frontier debt market has reached the scale at which more significant capital deployment is possible. In fact, successive external shocks have brought frontier-market debt yields and spreads to historically high levels, as shown in the Figure below.

Historic yields across various fixed income asset classes, %

Source: Ninety One as at 31 December 2023, Representative indices shown. EM LC Sov = JPM GBI-EM Global Diversified, EM HC Sov = JPM EMBI Global Diversified, EM HC Corp = JPM CEMBI Broad Diversified, Frontier HC Index = JPM NEXGEM, Global Agg = BBG Global Aggregate, US High Yield = Bloomberg US High Yield Corporate, Frontier LC Index = Portfolio of equal weighted frontier local markets (Azerbaijan, Botswana, Costa Rica, Egypt, Georgia, Ghana, Ivory Coast, Kazakhstan, Kenya, Morocco, Mongolia, Mozambique, Namibia, Nigeria, Pakistan, Serbia, Sri Lanka, Tunisia, Uganda, Ukraine, Uzbekistan, Vietnam, Zambia). For further information on indices please see Important information section.

Frontier-market fundamentals have been improving steadily over recent years, with growth, debt-to-GDP, and fiscal balances typically healthier than in some key developed markets.

Unsurprisingly, having faced significant pressure in 2022 and 2023 – with rising developed market yields, global recession fears and thinning liquidity weighing heavily on investor sentiment and causing external funding to dry up – a number of stressed frontier markets have defaulted. However, few now face refinancing risks, and the default cycle may well have peaked in frontier markets, unlike in many developed markets. While pockets of distress remain and successful navigation of the investment universe has become a more complex task, the potential rewards make it worthwhile.

With external pressures easing, we’re really starting to see asset allocators re-engage with the frontier market opportunity.

The term ‘frontier’ is often associated with a sense of the unpredictable, which in investment terms would equate to higher risk. Yet the reality is often more nuanced and requires an understanding of both the huge variety of economies this universe represents and the range of ways to access the opportunity set. Significant differences exist in the risk and liquidity characteristics of local versus hard currency frontier markets, even for the same issuing country, and these often relate to investor participation and degree of market development.

More broadly, the growth and demographic dynamics that favour frontier markets will see them continue to become a larger part of the global economy, and that frontier-market debt provides direct access to the long-term growth and development story. From a more cyclical perspective, as interest rate volatility declines, we expect to see an uptick in demand for relatively high yielding asset classes such as frontier-market debt.

In terms of the opportunity set, we still see potential in select hard currency debt markets where yields are well above those of similarly rated peers in developed markets, and where we see triggers for potential outperformance – such as Egypt (potential upscaled IMF programme). However, we are most excited about opportunities that are appearing in select local currency markets such as Uruguay, Paraguay, Kenya, Zambia – and we expect Nigeria to be added to this list over time. We believe these have the potential to offer significant risk-adjusted returns, with nominal and real yields remaining high across frontier markets and more benign external funding environments providing support for currency stability after a tough couple of years for select local currency frontier markets.

Frontier markets are currently at an exciting juncture where excessive premia meet improving fundamentals in a growing, under-invested and under-researched asset class. Informational asymmetries make detailed and diligent analysis vital, but frontier-market debt offers significant scope for attractive risk-adjusted returns for investors with the right expertise.

Main image: eva-blue-SfPOkp6-2eA-unsplash