The LIBF’s Juno Baker talked to ex footballer Jim McArthur on why after a playing career and then managing other footballers’ futures, he saw the need to become a financial adviser.

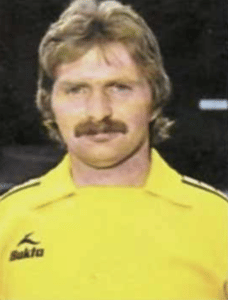

In the 1970s, Jim McArthur (pictured) had a successful football career, mostly in goal for Hibernian FC. But as a professional footballer he received little, if any, financial advice. He tells us how he made the transition from footballer to financial planner.

The world of professional football has changed dramatically over the last 50 years.

“When we were playing, in our early 20s or teens, someone might ask about your pension planning,” says Jim. “But you don’t think about a pension then. You’re a young person, no marriage on the horizon, no mortgage. You’re like, ‘what?’”

Jim had plans to become a coach once he retired from the beautiful game. “I couldn’t become a coach for various reasons but mainly because I started as an agent, looking after players, and following them during matches on a Saturday.

“I negotiate players’ deals – a good wage and a decent lifestyle. So, of course, you then start to look at their finances – life insurance, pensions, and investments. Which meant I became interested in that aspect as well.”

He’d talk to players about their income and suggest they seek advice from their banks. “But they weren’t getting great advice, or it would take too long. So I just thought I should sit my adviser exams and I am now an independent financial adviser with LJ Financial Planning Ltd.”

Now, as a football agent and a financial adviser, Jim provides an all-round service.

“It dovetails nicely. I could go to a player and say I can give you everything – organise your transfer, make sure you’ve got everything you need financially. I can do the whole shooting match.”

Financial advice for footballers

A few years ago, the headlines were full of stories about retired footballers struggling to make ends meet, prompting football associations to act.

Consequently, footballers are now much more aware they need to plan. “It’s getting better and better,” says Jim, “but still, some slip through the net.”

He explains that a footballer’s life is “a whoosh and whirl”. So much happens in the ten years of their career between ages 20 and 30.

When they retire from football, they may become coaches, managers or join another profession. For example, Jim continued his education and qualified as a teacher before going full-time with Hibs and in the afternoons teaching PE in several schools.

“But some fall by the wayside,” says Jim. “Many clubs have taken that on board. Because a percentage of the young boys at the top premiership clubs in England get released. They’ve nowhere to go in some instances. But now the clubs are assisting the transition in more cases.”

The Professional Footballers’ Association (PFA) and the Scottish Professional Footballers’ Association (SPFA) both take the issue seriously and try to offer financial education to players.

“Footballers are properly educated now,” says Jim. “We try to prepare them for life when they’ll not be at the clubs or maybe at a different club with less finances. Only a very small percent of players are paid huge money anyway.”

Young people and personal finance

The other side of this is that footballers are very young, especially early on in their careers.

We know from our own research, the Young Persons’ Money Index (YPMI), that 72% of young people aged 15-18 want to learn more about money and finance in school. That rises to 85% among 17–18 year-olds. Most want to learn about the practicalities of managing income and need guidance.

Some of the players Jim works with start their careers at 15 or 16. Asked whether we should be doing more financial education in schools, he says, “Yes of course we should!” He adds that professional footballers want to learn how to manage their income. “They’re thinking about it more, and more of them are doing it.”

Working with players from a very young age means that Jim enjoys long relationships with his clients. He describes working in financial advice as “a people industry”.

“You become acquainted with the people. You are an extension of their family, and you grow with them. You’re with them the whole journey. Most financial advisers are similar. You usually retain a client for their whole life.”

This article was first published on LIBF Insights