With 2023 now in full swing and everyone expecting a recession to hit, David Henry, investment manager at Quilter Cheviot, says investors should look out for five things happening this year and prepare accordingly.

1. Inflation is going to fall – by a lot

People hate costs going up. Not only is inflation bad for bonds, and bad in the short term for stocks (by placing downward pressure on valuation multiples), but by its nature all of us are reminded constantly of price rises every time we fill the car up or go to the shops. Most of us feel poorer in real terms now than we did this time last year, a conclusion that has been reinforced, over and over again, during thousands of transactions over the past year.

There is an old saying that the cure for high prices, is high prices. There is a point where people get a bit tired of spending £5.50 on a bottle of olive oil, and just decide to buy less olive oil. If most consumers are feeling the pinch, then it is likely that they will tighten their belts somewhat, and less demand means fewer cost increases.

The obvious counterpoint is that the job market remains strong, and wages are going up. But they still are not keeping pace with inflation.

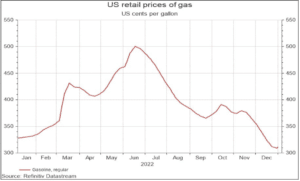

Inflation really started to move at the tail end of 2021, and so we are now coming into a period where ‘year on year’ comparisons are versus already elevated prices. For one example (there are others) just look at gas prices in the US – now lower than the beginning of 2022.

The benchmark that prices have to rise above to show positive year on year inflation is much higher than it was this time last year. The shorter-term numbers show that inflation is starting to fall, potentially rapidly. It might not make 2% this year in the US, but I do not think it will be far off by the end of 2023.

2. 2023 will be a better year for diversification

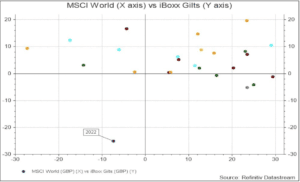

2022 was an appalling year for the two core portfolio asset classes, as you can see from the below (MSCI World calendar year returns plotted against gilts over the past 25 years).

I really would be surprised if both equities and bonds both have another bad year – bonds in particular. The starting yield for bonds at the beginning of 2023 is not only much higher than it was last year, providing more of a cushion and higher potential to offset equity market volatility – but fixed income investments also tend to do well in the early innings of a recession.

Inflation remaining far stickier than expected, or even rising again, is really the only way I could see bonds having a rough year – and for the reasons I have outlined above, I don’t see that happening.

3. The market is wrong on UK interest rates

Currently the market is forecasting a base rate of roughly 4.5% by the middle of July. I’m not buying that.

The Bank of England’s messaging over the past year has been, let’s just say, inconsistent – and as such it can be difficult to get a handle on the true direction of travel. There is already a little disagreement on the Monetary Policy Committee, with the recent move to 3.5% backed by only six out of the nine members.

We do not yet know the true impact of all of the interest rate rises that we have seen, there is a lag effect before these feed into the real economy, and so I do not think it’s beyond the realms of possibility that the Bank of England decide to pause sooner than expected, based on what I have said about inflation above.

The Bank of England has long been aware of how leveraged the UK is as a society to house prices and I do not think they would willingly inflict major damage on the property market.

4. Sentiment will stink, until it doesn’t

Sentiment is pretty grim at the moment. Consensus thinking expects a recession and a subsequent, as yet unclear, knock-on impact to company earnings.

The nature of the stock market means that what matters in the short term is whether the news is better or worse than current expectations. It’s all relative, and the bar for relative positive surprises is low. Historically buying at times of negativity has usually been a good idea. By the time the narrative improves and the ‘dust settles’ it is almost always too late, and the market has run up hard.

5. Predicting the future is futile

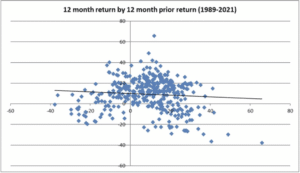

Despite my above predictions there is a chart that has stuck with me showing annual historical stock market returns, plotted against the returns seen in the previous calendar year.

If you are struggling to see a trend, that’s because there isn’t one. In other words, having a good, bad or indifferent year for the markets has historically offered no guide as to what we can expect the following year.

Embrace the uncertainty, control what you can control.

Returns for MSCI World Index

Source: Refinitiv Datastream.