With a hawkish Fed willing to push up interest rates to try to curb inflation, the risk of a hard landing has increased in the opinion of the Fidelity Solutions & Multi Asset teams.

Following last month’s surprisingly high US CPI print, and the subsequent 75bps hike from the Federal Reserve, discussion has swiftly moved on from whether a hard landing will happen at all, to when it will come and how severe it will be. The Fed’s growing hawkishness implies that it is now willing to inflict the pain necessary to bring inflation down. We believe the risk of a hard landing (we define it as global growth <1%) has risen sharply, from 35% before the CPI release to 60% today.

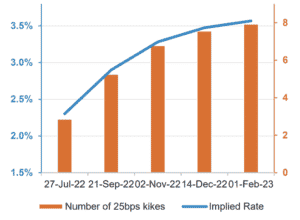

Inflation is peaking and should begin to fall over the summer. By hiking 75bps in June and opening the door to a further 75bps hike in July, the Fed is desperately trying to regain control of inflation and inflation expectations. Markets are expecting a Fed Funds rate of nearly 3.5% by the end of the year. We are on the dovish side of this, but uncertainty is high.

Chart 1: Market is pricing in a lot of hikes that may not materialise

Market implied Fed Fund Rate as of 27th of June. Number of hikes assumes 25bps hikes. Source: Fidelity International, Bloomberg, June 2022.

If the Fed is eager to get in front of the curve, the ECB is more of a reluctant hiker. Inflation in the euro zone is also high, and the ECB needs to raise rates to bring it down. However, the ECB must balance the additional risks of the fallout of the war in Ukraine and periphery spreads widening so much as to raise the cost of servicing the debt burdens of countries such as Italy, Spain and Portugal becoming a drag on growth. It looks likely that the ECB will combine hiking rates with a version of QE that focuses on periphery countries’ debt to ensure financial stability in the euro area.

Europe is also facing the exogenous shock of gas supply disruptions. European gas inventories are rising despite Russia severely limiting exports this year, indicating a combination of demand destruction and pre-emptive rationing. We are expecting further gas disruptions this year, which will pile more pressure on European industry and consumers. A recession in Europe is already our base case. The timing and severity of the coming slowdown will depend in large part on the amount of gas imported from Russia over the coming months.

Caution needed over hopes for China recovery

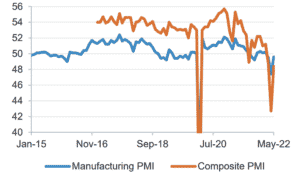

China is re-emerging from the strictest lockdown measures. Its economy has taken a terrific hit from the zero-Covid policy. Economic activity and output are now bouncing back, although still not to pre-lockdown levels. The property market, one of the main focusses of the reforms carried out in 2021, is still sluggish. Youth unemployment is nearly at 20%, a serious concern for policy makers who prize social stability. On the domestic policy front, the stance remains dovish with more easing on the way.

Along with tightening by the major central banks and the war in Ukraine, how fast China’s economy recovers will be a key determinant of global growth over the next 12 months. We would urge caution about the speed of China’s recovery. Retail sales are still struggling, and how consumers and corporates will react as they gradually return to life without Covid restrictions is highly uncertain. Policy might be gently easing, but internal politics can be unpredictable. Government bond issuance, a proxy for investment, remains lows.

Chart 2: China PMIs bouncing back but still in contraction

Source: Fidelity International, Bloomberg, June 2022.

Global consumers under pressure

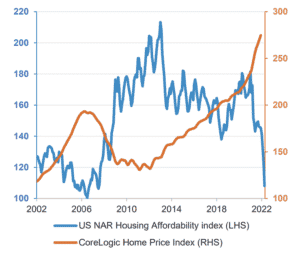

How long can consumer spending stay strong in the face of rising inflation and falling real wages? US consumers have been relatively resilient this year. Consumer balance sheets are strong and retail sales has held up well. But cracks are starting to appear – the collapsing confidence we have been picking up in our proprietary activity trackers is starting to show up in hard data. Real wage growth has fallen in major economies, and a cost-of-living crisis is spreading.

The housing market will become the primary agent via which tightening financial conditions will cool end demand in the US. House sales are already beginning to wobble, while mortgage rates have risen sharply.

Chart 3: US consumers hurt as housing affordability plumets

Want to learn more?

This content comes from Fidelity Multi Asset’s Global Asset Allocation July report. Fidelity’s Global Macro & SAA team contributes to Fidelity Solutions & Multi Asset’s tactical asset allocation process by providing key macro inputs, working alongside the investment team to understand and respond to the macroeconomic drivers of markets.

Important information

This content is for investment professionals only and should not be relied upon by private investors. The value of investments and the income from them can go down as well as up and clients may get back less than they invest. Past performance is not a reliable indicator for future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Fidelity’s range of funds can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Due to the greater possibility of default, an investment in a corporate bond is generally less secure than an investment in government bonds. Changes in currency exchange rates may affect the value of an investment in overseas markets. Investments in emerging markets can be more volatile than other more developed markets. Reference to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority and Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0722/371086/SSO/NA