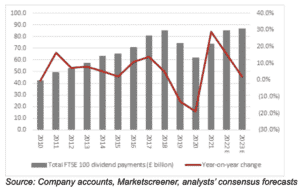

Shareholders could be in line to receive £85 billion in dividend payouts from FTSE 100 firms this year, up from £78.5 billion in 2021, new research has shown.

The Dividend Dashboard published by AJ Bell said the payout all but matches the record payment made by FTSE 100 firms of £85.2 billion in 2018.

Mining giants and housebuilders have helped to drive the increase with Rio Tinto, Persimmon and Glencore all offering shareholders a potential 10%+ yield, while the number of firms expected to pay a dividend this year is also on the up.

According to AJ Bell’s findings, 97 FTSE 100 firms are expected to pay a dividend, compared to 91 in 2021 and 85 the previous year. Despite concerns over increases to input costs, coupled with interest rate rises and increases in taxes for 2023, analysts are continuing to bolster their dividend payment forecasts.

The FTSE 100 is expected to deliver a yield of 4.2% thanks to a combination of share price falls and increases in dividend forecasts, says Russ Mould, investment director at AJ Bell.

“The index’s total dividend payout is expected to reach £85 billion excluding special dividends. It means total payments could surpass 2018’s record, although the current expectation is that they come in just shy of the £85.2 billion record.”

However, Mould warned that while forecast yields sound attractive, investors should take note of the records of firms previously expected to generate bumper payouts.

Mould says: “Firms including Vodafone, Shell, Evraz, Centrica, Royal Mail and Marks & Spencer were all due to pay a dividend over 10% as a FTSE 100 firm at one time or another. Instead, they cut their dividend, demonstrating nothing can be taken for granted, especially if a recession hits.

“In fact, history tells us that it isn’t necessarily the highest-yielding stocks that prove to be the strongest long-term investment. The best performance often comes from those with the most consistent long-term dividend growth record.

“Sadly, the ravages of the pandemic and the economic climate have led to a rout in the number of FTSE 100 firms able to boast a ten-year dividend growth track record.”

Two years ago, 24 firms made the list, but this number has since fallen to 17, despite National Grid, United Utilities, Dechra Pharmaceuticals and Hikma Pharmaceuticals joining this group in 2021.

The average capital gain from the 17 ten-year dividend growers is 311% and the average total return is 436%, says AJ Bell.

Mould commented: “The charms of these seventeen names are now well understood and they often fall into the ‘quality’ bucket of many portfolios. But ‘quality’ does not guarantee safety if the valuation paid to access the cash flow and dividend streams” is too high. Some of these names have suffered a bit of a reckoning in 2022, at least to date, as the twin tides of higher interest rates and lower risk appetite have pushed investors away from expensive, ‘quality’ names that have generally done well for the last decade toward cheaper, ‘value’ names that have generally performed poorly. Of the seventeen serial dividend growers, only one – BAT – is in the top ten performers within the FTSE 100 this year to date.”

Mould says that investors seeking dividend security should look for stocks with dividend cover of 2.0 or over because it means profit is double the amount the company is paying out to shareholders. In contrast, dividend cover of below 1.0 should “ring alarm bells” because it means the company is paying out more than it makes in that year and will have to dip into cash reserves, sell assets or borrow money which is unlikely to be sustainable over the long term.