Diversification within a portfolio is crucial to minimise the amount of risk we are exposed to. Correlation is an important part of this too, explains the Brand Financial training team.

Correlation is the degree to which the returns on two investments are linearly related.

Correlation can be positive, negative or there can be no correlation at all between investments.

Positive correlation

- A correlation of +1 suggests that two investments are perfectly positively correlated.

- This means that both move in the same direction (up or down).

- This type of correlation offers no reduction in risk.

Negative correlation

- A correlation of -1 suggests that two investments are perfectly negatively correlated.

- This means that when one goes up, the other will go down.

- This is ideal for diversification and the reduction of risk as the two returns cancel each other out.

- In reality, it would be impossible to find two investments like this.

No correlation

- A correlation of 0 (zero) suggests there is no correlation between two investments.

- Each investment will very much do its own thing.

- At times they move together and at other times they move in the opposite direction.

- Where there is no correlation, this offers some reduction in risk.

A portfolio with investments showing a low correlation (of 0.1 or 0.2) results in less risk for the investor and may even help to enhance returns.

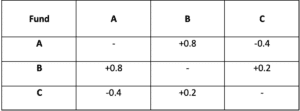

Let’s look at a correlation table comparing three investment funds:

By using this table, we can see how each fund behaves in relation to the other.

Fund A and fund B are positively correlated. We can therefore say that if fund A were to go up by 10% then fund B would go up by 0.8 of this, in other words by 8%. If fund A were to go down by 10% then fund B would go down by 8%. This is a high level of correlation and it may be wise to look for less correlated assets to reduce the risk.

Funds A and C are showing a negative correlation of 0.4 – this means that if fund A were to go up by 10% then fund C would fall by 0.4 of this, in other words it would fall by 4%. The fall in C is compensated by the increase in fund A.

Funds B and C are showing a positive correlation of 0.2. This means that the funds will move in the same direction so if fund B fell by 10% then fund C would also fall, but only by 2% so they have very low positive correlation.

The key to building a portfolio is diversification; the returns on investments in the same sector tend to have a high positive correlation, whereas the returns on investments in different sectors tend to have a low positive correlation. It makes sense, therefore, to ensure that we are investing across different sectors to create that well-diversified portfolio to reduce overall risk.

About Brand Financial Training

Brand Financial Training provides a variety of immediately accessible free and paid learning resources to help candidates pass their CII exams. Their resource range ensures there is something that suits every style of learning including mock papers, calculation workbooks, videos, audio masterclasses, study notes and more. Visit Brand Financial Training at https://brandft.co.uk