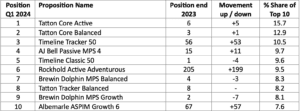

Tatton Core Active was the most recommended management portfolio solution in the first quarter of 2024, according to Defaqto, closely followed by the Tatton Core Balanced solution.

In a list of the top 10 most recommended MPS by value, Defaqto said the highest new entrant was Timeline Tracker 50 in third place, while the most recommended solution in 2023, Timeline Classic 50, dropped four places to fifth.

In total, the first three months of this year have seen four new entrants appear, with the two biggest climbers being Rockhold Active Adventurous and Albemarle ASPIM Growth 6 solutions.

Andy Parsons, insight manager, funds and DFM at Defaqto, said: “As the table clearly shows, there are a variety of investment solutions being chosen across a multitude of varying styles and risk levels. Leading the way is Tatton with three solutions in the top 10, whilst the likes of Brewin Dolphin and Timeline are represented twice.

“In an advisory world, where time is becoming an ever scarcer resource, due to an ever-increasing regulatory workload, clients rightly expect investment solutions that deliver in terms of associated risk, performance and cost. Advisers are understandably seeking out investment solutions where all the tough challenges of asset allocation, geographical and sector preference, growth versus value and mega cap versus small are done for them.”

Parsons added that the expansion of the MPS arena will continue throughout 2024 and said it is important that advisers are assisted in their decision making, due diligence and comparisons of potential solutions.

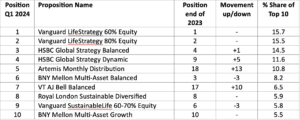

Separately, Defaqto said the top multi-asset investment solutions saw very little change in the first quarter, with only two new entrants to the top 10.

Vanguard LifeStrategy 60% Equity fund retained its pole position, with Defaqto noting that advisers “clearly see this type of strategy as a core component when recommending a diversified portfolio.” Vanguard LifeStrategy 80% Equity was named the second most recommended multi-asset investment solution, while Vanguard SustainableLife 60-70% Equity came in ninth.

When comparing the overall value of recommendations for the top 10, the three Vanguard solutions accounted for 37% of total value.

The two new entrants to the top 10 table were Artemis Monthly Distribution, which came fifth, and the VT AJ Bell Balanced Solution, which came seventh.

Parsons said: “Often perceived as the alternative solution for those advisers who prefer not to use an MPS proposition, the top 10 is represented by six different providers. Vanguard leads the way with three solutions, whereas both HSBC and BNY Mellon are represented twice. Interestingly, only one solution within the top 10 has a yield currently in excess of 4%, that being the Artemis Monthly Distribution at 4.7%.

“In a year where so much regulatory focus will turn to the new SDR rules in the summer, two of the top 10 are sustainable solutions, clearly showing that advisers and their clients do want to be seen to be making a difference to the world in which they live and the legacy they can leave for the future generations.”

Top 10 recommended MPS investments – Q1 2024

Top 10 recommended multi-asset investments – Q1 2024

Main image: martin-sanchez-NfLZeAN7I6s-unsplash