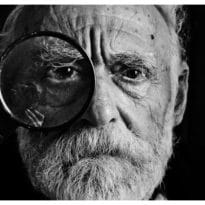

Richard Stutley, portfolio manager, MGIM, provides an overview of the firm’s global macro outlook.

The scope of the macro work we do is twofold: firstly, we aim to formulate a view on key macroeconomic variables, specifically growth, inflation, interest rates and geopolitics (although not strictly a macroeconomic variable…). At times these key macroeconomic variables inform the bottom-up work the team does.

Secondly, we reflect on market dynamics and whether any high-quality indicators suggest we should be bullish or bearish in the short term.

With respect to growth, we broadly agree with the International Monetary Fund which is forecasting a weak five-year period for global growth, with the global economy expected to expand more slowly than during the last 20 years and over its longer-term history. Overall, we do not see grounds for any sudden surge in growth. The implication of this for analysts doing bottom-up research is that they should use conservative economy-wide growth assumptions in their models (to the extent that growth in the global economy has a bearing on the particular company they are analysing).

As one would expect, there are big differences between regions: within emerging markets, India (which overtook China as the largest country by population in April) is expected to pick up the baton as the global growth engine, with annualised growth of 6% over the next five years. Meanwhile, in developed markets, growth in the US has surprised to the upside, whereas the outlook for the EU has deteriorated, with the spectre of stagflation re-emerging.

While inflation is highly uncertain, we think central banks are serious about delivering on their inflation targets and therefore, we expect any renewed inflationary pressures to be met by decisive action from policymakers. As such, we caution against the view that we are likely to see a protracted period of either especially high or especially low inflation over the next five years.

Interest rate policy has entered contractionary territory and policy rates are therefore likely to fall over time, consistent with the Federal Reserve’s latest dot plot, which shows forecasts from members of the rate-setting Federal Open Market Committee as to where interest rates will be by the end of 2023, ’24, ’25 and over the longer term. However, interest rates are likely to settle at a level above their lows from the previous cycle. Zero interest rate policy and quantitative easing were a mistake in our view, leading to asset price bubbles and greater inequality; we don’t expect central banks to make the same mistake again.

Finally, with regards to geopolitics, we are currently in a holding pattern in terms of US-China and Russia-Western relations. Next year’s US elections will take on increasing significance, but for now, it’s a case of wait and see, while building resilience into portfolios in order to deal with bouts of volatility ahead.

Taken together, we foresee a relatively tough macroeconomic environment for companies to operate within. Added to that, our five preferred risk indicators, which includes things like the shape of the yield curve, also call for a relatively cautious stance today. Despite that fact, risk aversion – as measured by our proprietary indicator, which looks at key relationships between asset prices – is not far from its median, suggesting that market participants are relatively relaxed currently.

Overall, then, our weak economic outlook is endorsed by our standard risk indicators and does not appear to be reflected in markets. Naturally, this then leads us to be cautious in the short term and to demand a high margin of safety from all our investments. However, any view of valuations/fair value is ultimately driven by detailed bottom-up analysis, from which attractive opportunities are almost certain to emerge in spite of this weak macro backdrop.

Main image: christian-lue-mJmYluOzx6g-unsplash