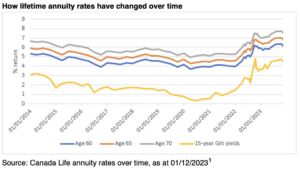

Annuity rates have jumped by 54% over the past two years, according to Canada Life.

At the start of 2022, a benchmark annuity bought for £100,000 would have paid an income of £4,540 a year for someone aged 65 with no health conditions.

The same annuity would now pay around £7,000 a year, with rising interest rates and the return available on gilts driving the increase. Over the course of a 20 year retirement, an annuity at today’s rate would pay out an extra £49,200 in income compared to two years ago.

Nick Flynn, retirement income director at Canada Life, said: “Annuities have been on quite a remarkable journey. While many had effectively written off annuities due to the perceived poor value being generated, they are now very much back in vogue due to the rapid change in fortunes.”

Flynn said benign investment conditions and economic uncertainty has led pension savers to seek security in their retirement income.

He continued: “In a perfect storm, annuities are the only safe ship in town which can guarantee 100% income security that no matter what happens your income will continue to be paid. Consumers are seeking a mix and match approach, combining annuities with drawdown which can often generate a better retirement income.

“Balancing the need for security and flexibility and de-risking drawdown investments over time by banking the annuity rate can be a smart move.”