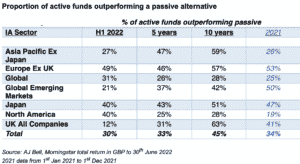

Less than a third (30%) of active equity funds have outperformed a passive alternative so far this year, down from 34% a year earlier, according to AJ Bell.

The AJ Bell Manager versus Machine report showed that active performance has been particularly challenging in the UK, where only 12% of active funds have outperformed a passive alternative compared with 41% in 2021, with mid and small cap exposure proving particularly difficult for active managers.

The average UK active fund returned -13.5% in the first half of this year, compared to -4.4% from the average passive fund.

While energy stocks provided a boost for the FTSE 100, sentiment towards the growth stocks that feature heavily in the small and mid-cap sections of the London Stock Exchange have turned sour, resulting in steep price falls.

In contrast, 40% of US funds outperformed, a significant improvement on the 19% recorded last year. However, longer-term performance of US active funds has been disappointing, according to Laith Khalaf, head of investment analysis at AJ Bell.

Khalaf said that in the long term, the underweight position in large caps has had the opposite effect on US active managers than in the UK All Companies Sector, because large cap stocks have led market performance over the last ten years in the US, leaving mid and small caps trailing in their wake.

Khalaf said: “2022 is not shaping up to be a good year for active fund managers. Overall, only 30% have beaten a passive alternative in the first half, down from 34% in our 2021 Manager versus Machine report. That’s despite choppy market conditions which one would normally expect to favour the flexibility of active funds over the rigid investment strategy of index trackers.

“While there has been a considerable improvement in active fund performance compared to last year amongst US funds, and a modest improvement in Global funds, very few active managers in the UK All Companies sector have been able to beat a typical tracker fund. There are so many funds in this sector that a poor showing here has been a big swing factor for active management as a whole, with the result that overall active fund performance has deteriorated in 2022 compared to last year.”

Positive news for active fund investors

Khalaf said the longer-term figures look more positive for active funds, with 45% outperforming a passive alternative over 10 years.

Khalaf commented: “That’s less than half of course, and will be flattered by survivorship bias, as unsuccessful funds will tend to wind down or be merged into others. Nonetheless that does still mean a large chunk of active funds have outperformed an index tracker over the last decade, which gives active fund investors some cause for optimism. So does the fact that the success of active managers is not uniform across fund sectors, which furnishes investors with the opportunity to pick and choose which parts of their portfolio they populate with active and passive strategies.”

According to Khalaf, while statistics suggest that picking an active fund that outperforms over the long term is “no better than a coin toss”, investors can tilt the odds in their favour by splitting portfolios between fund managers and passive machines, based on where they see the biggest rewards from active management.

Khalaf added: “Unlike the most vociferous disciples of active or passive management, investors can afford to be pragmatic, not dogmatic, in their fund selection. By picking competitively priced tracker funds, and supplementing this with a bit of judicious active fund selection and diversification, they can give themselves a good chance of achieving portfolio outperformance in the long run, through a combination of both active and passive strategies.”