With-profits funds can help investors weather stormy markets, says Martin Shaw, chief executive of the Association of Financial Mutuals.

Even before Covid-19 arrived in the UK, volatility in the value of shares seems to have grown steadily in recent years. Much of this stems from the fact that markets are able to respond more quickly to worldwide events with the advent of high-frequency trading fuelled by 24-hour news and social media, and because sentiment seems to be changing more quickly than the British weather.

In 2020, a perfect storm of coronavirus, a looming post-Covid recession, Brexit and the US elections are changing investor perceptions on a daily basis. Although the UK stock market grew 9% in Q2 2020, the market is still down 18% year-to-date.

For the average cautious investor or pension trustee the level of volatility in the market is a major turn-off. The last time we saw such adverse conditions for investing in 2008/09, people turned to safe havens such as cash, government bonds and, yes, with-profits.

During the financial crisis of 2008/09, many members of the Association of Financial Mutuals (AFM) recorded record sales volumes. People saw mutuals and friendly societies as a safe pair of hands, and those customers for whom with-profits savings were appropriate valued the capacity of the product to smooth out the peaks and troughs of the market.

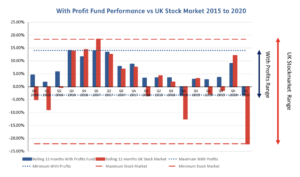

The chart below, which is based on analysis by a member of AFM, shows that over the past five years the UK stock market has, on a rolling 12-month basis, reported negative quarters almost as often as it has positive (eight quarters versus 10). This is compared to just two negative quarters for with-profits and 16 positive. Furthermore, in only five of the 18 quarters did the market outperform with-profits.

With regard to volatility, the chart also demonstrates that the range of quarterly performance for the stock market of between +18% and -22% is more than twice as great as that for with-profits. This, of course, means that a with-profits product offers a much more secure option for the cautious investor.

Why with-profits?

There are two main features of a with-profits product that allow for this more reliable performance: the allocation of bonuses and smoothing. In a with-profits product, the provider declares a bonus rate each year and once a bonus is declared it cannot be taken away as long as the customer maintains the contract up to maturity. Smoothing means the provider will set the rate of bonus by taking a long-term view, rather than simply reflecting the most recent performance of the underlying investments.

There are other features of a with-profits product that help reduce volatility, which include:

1. The product can invest in a wide range of assets, including bonds, gilts and property – not just the stock market – and that diversity helps offset market falls.

2. When the product matures the provider may pay a terminal bonus in addition to the annual ones.

3. The with-profits product may feature a guarantee, meaning that at the end of the term, or on death before maturity, a specified sum will be payable.

It would also be remiss of me not to mention that in absolute terms with-profit policies invested with a mutual insurer or friendly society have, according to AFM research, provided investment returns much greater than an average unitised product with a similar structure. As a result, with-profits are particularly worth considering for investors with a set timeframe in mind or who have a long-term view, such as planning for retirement or paying for a child’s education, as they would potentially benefit from the more predictable and superior returns offered.

Greater transparency

People with a long memory may recall the concerns surrounding with-profits as a result of the mis-selling of mortgage endowments in the last century and the failure of Equitable Life in 2000. However, since that time the degree of regulation has intensified significantly and with-profits providers now need to set aside enough capital to cover all their liabilities as well as to allow for one-in-two hundred year events (which seem to be happening quite a lot lately). There is also a high level of transparency in the way the product is managed and boards are subject to extensive governance requirements.

According to a report issued last year by the FCA, at the end of 2017 there was around £247bn invested across 14m with-profits policies. While this had fallen from a peak of over £400bn, as the FCA stated it still represents a “significant portion of the long-term savings, pension and retirement income provisions of customers in the UK”.

We can expect further turbulence in the stock market over the coming months and investors will be wary about the prospects for their portfolio. By ensuring with-profits makes up part of their assets, they can continue to enjoy growth when the markets are high and suffer less in the downturn.

With-profits truly is a fund for all seasons.