For this month’s three year track record, Juliet Schooling Latter, research director FundCalibre, looks at US small and mid caps through the lens of the T. Rowe Price US Smaller Companies.

Regardless of whatever metric you use the US economy looks very expensive at the moment.

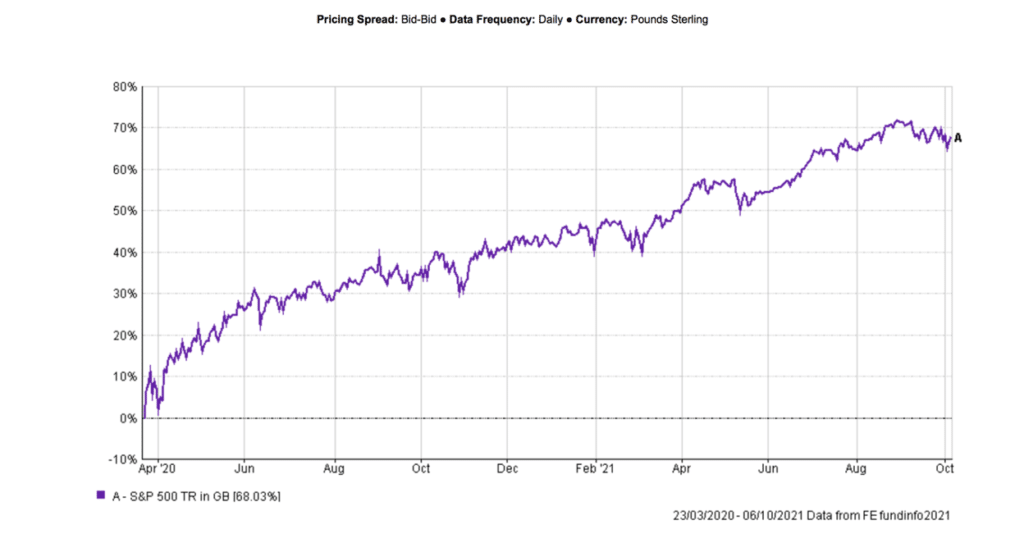

Spearheaded by a number of tech behemoths, the S&P 500 is up almost 70 per cent from the lows of March 2020*. I’m not going to say big tech is set to fall from grace, but you have to be very brave to heavily back the FAANGs at their current prices.

However, we’ve always felt small and mid-caps are where you make the big, long-term returns from investing – and there remains a plethora of opportunities in the world’s largest economy.

Sometimes we have to remind ourselves of the size of some of these companies compared to other parts of the world. In the US, small-caps stocks are generally regarded as firms with a market-cap below $3bn, while mid-caps can be as much as $15bn – they are very different beasts**.

Market composition also differs. Cyclical sectors make up more than half of US small and mid, whereas technology, internet, media and telecom – traditional growth sectors – account for less than 20 per cent. This is not the case for large cap where the S&P 500 has had 30 per cent in technology stocks recently**.

There’s also the research angle – each company in the Russell 2000 is covered by around 5.6 analysts, contrast that to the 20.6 covering the S&P 500***. There are opportunities aplenty if you have the right resources behind you – and this month’s fund is run by an asset manager with a market-leading in-house analyst team that is dedicated to finding those opportunities.

The T. Rowe Price US Smaller Companies Equity fund has a style agnostic approach to investing in companies in the small and mid-cap space.

The fund is a ‘best ideas’ strategy that levers off the support of some 40 analysts (as well as that of industry contacts and external brokers) to find those ideas. This means manager Curt Organt will buy a diverse set of stocks, whose market cap is below $12bn, that have both value and growth characteristics, but are likely to be the winners over the next five plus years.

Curt will conduct intense fundamental analysis, looking at different factors for different types of stocks. This work has a heavy emphasis on free cash flow generation with sound or improving financial leverage. Curt will also want management teams whose goals are aligned with shareholders, a solid plan for the business and a track record of delivering in the past.

For the value ideas, he will look at what the company’s issue is, the time frame for resolution and the absolute and relative valuations. These stocks are not structurally challenged, but are under pressure for cyclical reasons. They will be firms that still have an enduring competitive advantage, but are cheap due to an external factor. The growth names are more likely to be those with a stable outlook and sustainable underlying growth drivers.

The final portfolio will hold between 150-200 stocks, this allows Curt to take positions in certain themes whilst minimising single stock risk. Largest holdings at present include materials science and manufacturing company Avery Dennison, Molina Healthcare and Domino’s Pizza****.

Since Curt took over at the helm in March 2019, the fund has returned almost 60 per cent to investors^. Ongoing charges stand at 1.12 per cent^.

The style agnostic process behind this fund does differ from the T. Rowe Price norm, but it has clearly borne fruit, with considerable performance coming from stock selection. Curt is very detail-orientated and has been working as a specialist analyst for many years, allowing him to build up a large knowledge base of the US smaller companies universe. We believe the fund will continue to prosper under his leadership.

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.

*Source: FE Analytics, total returns in pounds sterling, figures from 23 March 2020 to 6 October 2021

**Source: Schroders – Four reasons for investing in US small and mid-caps (and four challenges)

***Source: Furey Research Partners

****Source: Provider factsheet at 31 August 2021

^Source: FE Analytics, total returns in pounds sterling, figures from 29 March 2019 to 6 October 2021