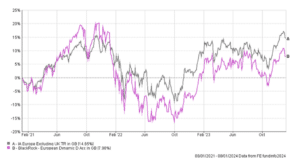

For this month’s article examining the three-year track record of funds and managers, Juliet Schooling Latter, research director at FundCalibre, turns her attention to European markets and the BlackRock European Dynamic fund.

If investors ignore the tech-driven distortions of the US market, and the transitory charms of a couple of emerging markets, a surprising sector bubbles to the top of the performance league tables in 2023: Europe. European equities have even outpaced the recovery in Japanese equities last year; while UK and Asian funds have been left trailing far behind.

But the stock market and the economy are two fundamentally different things. Many European economies, including Germany, have either entered – or are flirting with – recession, as monetary conditions hit home. The French and Italian economies, for example, produced GDP figures of -0.1 and +0.1 per cent respectively in Q3, 2023*.

The outlook – like the rest of the global economy – is decidedly mixed. On the one hand there is hope that rates have peaked and inflation is starting to fall. Standing at 2.4 per cent, the annual eurozone consumer price inflation rate for November was the lowest since July 2021, and only slightly above the ECB’s 2 per cent target*. The fear is that is far from guaranteed that we will not see inflation spike again – due to the impact of the ongoing war in Ukraine and another energy shock.

There are other tailwinds also to consider. A recent research update from Lazard points out that returns on equity (RoE) for European companies have been climbing, in contrast to falling RoEs in other parts of the world. Businesses have also been boosting balance sheets; while companies are also taking advantage of depressed valuations to buy back stocks at twice their historic average*.

For me, I always try to cut through the noise in Europe and keep it as simple as possible. As one fund manager I spoke to summarised perfectly: “When has Europe ever been a good place to invest as a whole? There is always something to worry about in terms of dysfunction from either an economic or political perspective. That is what gives active investors in Europe the opportunity to find great, globally exposed companies at attractive valuations – because of the stigma around Europe as an investment arena.”

Ultimately, there are always great opportunities to access regional and global companies in Europe. It has also become a region which has become more diverse in its investment outlook. Gone are the days when it was all about cyclical financials and commodities – step forwards the likes of technology and healthcare.

This month’s fund is well positioned to tap into these trends.

BlackRock European Dynamic invests in companies of all shapes and sizes across Europe. Given the size of the fund, it is relatively concentrated at around 50-55 stocks. Manager Giles Rothbarth has a flexible approach, looking for companies that are either undervalued and/or have good growth potential across different time periods.

Rothbarth became co-manager of this fund in 2019, before taking sole charge in early 2021. He previously ran the company’s Continental European fund as well as being part of the 13-strong European equity team where he has specialised in the financials sector.

Giles’ focus is on companies that are likely to surprise positively in terms of earnings and growth. The fund is unconstrained with regard to company size and sector. It invests in companies with medium to long-term earnings power that is greater than the market, and also those in restructuring and turnaround situations. The approach is flexible, varying through market and economic cycles to position the portfolio appropriately.

The manager uses a range of externally-sourced and proprietary screening tools to help filter the investment universe and identify ideas for further in-depth research. Research is central to the investment process and a key source of alpha for the fund. The team has a structured framework in place that includes a proprietary research template that provides a comprehensive and consistent framework for each stock containing price target and rating.

Analysts are expected to look for new ideas as well as cover existing holdings, but not to spend time on maintenance research. Portfolio managers have exceptional access to senior management within the companies they invest, conducting hundreds of meetings every year. The output of the investment research process is a clear recommendation and a price target. The price target forecasts a target price 12 months from today. The team uses a rating system from 1–5 when recommending stocks: 1 (strong buy), to 5 (very negative). This rating signals the level of risk-adjusted conviction the analyst has for the investment case.

Single stock weightings are typically 2-3 per cent below or above the benchmark weighting to make sure risk is not dominated by any particular stock. Rothbarth employs a strict sell discipline, setting price targets early in the process to ensure he doesn’t fall in love with his stocks.

The top 10 holding currently account for almost half (44 per cent) of the fund, with Novo Nordisk (9.8 per cent), Linde and LVMH (5.2 and 4.8 per cent respectively) making up the top three**. The fund is also well diversified in terms of sector and geography.

The fund is one of the best in a competitive sector, with a genuinely flexible approach and a willingness from the team to constantly refine and enhance the fund’s process. It is a genuine style agnostic product backed by one of the best European teams in the market.

*Source: Lazard Asset Management, Outlook on Europe, January 2024

**Source: fund factsheet, 30 November 2023

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.

Main image: calvin-hanson-POqJeWrVfnU-unsplash