Innovation has transformed the world and impacted everything from the way we travel, communicate and work. Although historically been viewed as an imitator, China is now at the forefront of the next wave of innovation. Fidelity’s Asia equity team team outline three themes set to define China’s future dominance and where the investment opportunities lie.

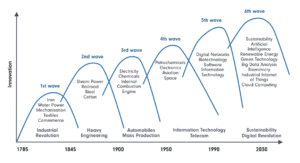

We are living in a golden age of innovation and the pace of change is intensifying. For example, it took 70 years for the washing machine to reach full penetration, 20 years for colour television but only five years for social media. We expect the next innovation waves to drive exponential growth in companies that develop, enable and adopt these disruptive forces.

From a geographical perspective, China is at the forefront of the next wave of innovation, partly due to its significant structural advantages. As the so-called godfather of Artificial Intelligence Kai-Fu Lee once said, “Data is the new oil, and China is the new Saudi Arabia”.

Data creation, access and analysis are paramount to the development of the next generation of innovations. China has created more data than any other country and continues to outgrow global data growth. Additionally, the country is uniquely positioned at the crossroads of innovations – both as a source and a destination for the most innovative companies.

Domestically, government policy and regulations have long been supportive of innovation, an effect that is now materialising. As such, we believe China’s structural advantages make it a fertile ground to develop innovative products and services.

Waves of Innovation drives growth in productivity, population and economy

Source: www.oxfordre.com

This in turn will have significant implications for the shape of future returns from Chinese equity markets. Indeed, from an investment perspective, we have identified technology, environmental and lifestyle innovation as the three key themes that will be significant drivers of change and growth for at least the next few decades.

Theme one: Technology innovation

It is estimated that the ‘technology innovation’ theme will see the total addressable market increase from US$738bn in 2019 to US$2.2trn by 2025, led by the growth in AI software, autonomous vehicles and the internet of things.

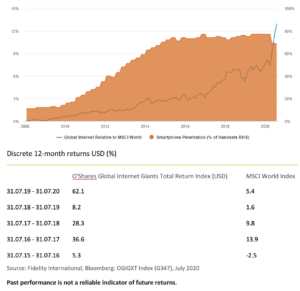

The enormous breadth of use cases for technological innovation mean that this theme will have a long duration. AI and automation have the potential to disrupt almost every sector to varying degrees, much the same way as the internet has. Since the introduction of the iPhone, the global internet sector has hugely outperformed global equities and continues to do so. We see potential for AI and automation-related stocks and sectors to follow suit over the next decade.

Global internet sector has outperformed since the introduction of the iPhone

Stock example: Glodon

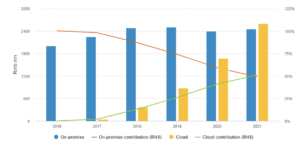

Glodon is a leading AI enhanced software provider for the construction industry in China. Its software helps construction companies digitise the cost estimation, quantity surveying and project management functions of a project. Digitising processes both reduces the customers costs as simplify the processes, with their dominant market share a testament to the quality of their solution.

Earnings growth will be driven the transition to a Cloud software-as-a-service model and the increasing penetration of construction management software which is currently nascent. Additionally, developed market peers have shown that the increased visibility of recurring earnings from the transition to the SaaS model can lead to a significant valuation re-rating.

Cloud revenue growth and contribution forecast

Source: Macquarie; January 2020

Please note: The figures cited for 2020 and 2021 are projected

Theme two: Environmental innovation

This is the theme linked to development and application of products and processes that contribute to sustainable environmental protection and ecological improvements. Key areas here include electrical vehicle (EV) makers and supply chain, waste treatment and alternative energy.

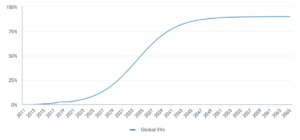

From an investment perspective, one of the main opportunities we have identified is in electric vehicles. As battery prices continue to decline driven by advances in technology and scale, they will become more economically competitive with traditional combustible engines, leading to exponential growth in battery demand over the next 10 years.

China has the largest battery manufacturing capacity in the world with potentially 65% market share by 2023. Leading players will benefit from the soaring electric vehicle demand.

Battery manufacturing capacity global breakdown

Source: Bloomberg, Fidelity International Estimates, May 2020

Stock example: Contemporary Amperex Technology Co Ltd (CATL)

CATL is the world’s largest electric vehicle (EV) battery supplier with 24% global market share and over 50% market share in China. It supplies most of the major Chinese auto manufacturers and some major global players like Daimler, BMW and VW. Its leadership has been underpinned by technical superiority and upstream integration.

With EV penetration still nascent but nearing the inflexion point, as battery costs decline and regulatory pressure on fossil fuel cars intensifies, the total addressable market will grow rapidly.

Projected global EV penetration

Source: Fidelity International, Bloomberg January 2020

Theme three: Lifestyle innovation & Conclusion

Page: 1 2