Theme three: Lifestyle innovation

This theme is based around transforming and improving our lives through innovative solutions.

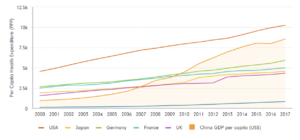

China’s per capita spend on healthcare is a fraction of that of their developed peers. However, as incomes grow, and the population urbanises, we are likely to see growth in China outstrip other markets.

Per capita health expenditure

Source: WHO, Fidelity International, March 2020

With foreign companies currently dominating innovation, patent-protected pharmaceuticals, innovative Chinese biotech companies with world class R&D capabilities have huge scope to develop their own drugs and tap this underpenetrated market.

Recently, the Chinese government completely transformed the drug approval review process. It is now faster, more transparent and with higher assurance of quality. Meanwhile, China’s drug development is increasingly integrated with the rest of the world which encourages those with the know-how to utilise the large Chinese patient pool for fast clinical trials. The R&D talent pool in the China is also improving attracted by the opportunities in China. As a result, China will steadily deliver more and faster drug innovations.

Stock example: Wuxi AppTec

Wuxi AppTec is one of the largest pharmaceutical outsourcing service providers in Asia. Established in 2000, the company provides pharmaceutical, biotech, and medical device R&D and manufacturing services to global customers in terms of advance medical discoveries and treatments for patients. Wuxi AppTec’s innovative and industry leading capabilities in areas such as R&D and manufacturing for molecule drugs to cell and gene therapies is accessed by customers through its open-access platform, which has seen partnerships for close to 4,000 collaborators from over 30 countries.

We believe Wuxi Apptec is a long-term earnings compounder that is expected to benefit from increasing Chinese and global demand for CRO (contract research organisation). Being a first mover in this segment, we don’t see any meaningful competition both from global and Chinese domestic players. The company’s strong entry barriers are a result of a solid track record, its innovative strategy, its ability to attract and retain talent and focus on next generation cell/gene therapy where it is a leading player.

Strong client demand for outsourcing continues to underpin Wuxi AppTec’s business, especially as more global clients opt to outsource laboratory work given disruptions seen in their US or European operations due to the outbreak of Covid-19. With Covid-19 becoming a global pandemic, unmet medical needs are strongly required; the Chinese regulator has given Covid-19 related drugs and vaccines work priority when reviewing any clinical trial data although the actual trials process has not been shortened.

Conclusion

China is a fertile ground for innovation and its huge market provides companies with the potential to quickly scale up successful innovation. Although the types of innovations will evolve over time, we believe the innovation theme and China’s leadership is perpetual in nature.

Innovation is not confined to the technology sector but is increasingly encompassing areas such as lifestyle and environmental. Through our fundamental bottom-up research and local insight, we can invest in the leading areas and companies that offer “innovations by China and innovations for China”.

Learn about Fidelity’s Asia expertise and investment strategies HERE.

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Changes in currency exchange rates may affect the value of an investment in overseas markets. Investments emerging markets can also be more volatile than other more developed markets. Reference in this article to specific securities should not be interpreted as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. Investments should be made on the basis of the current prospectus, which is available along with the Key Investor Information Document, current annual and semi-annual reports free of charge on request by calling 0800 368 1732. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority and Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0820/26817/SSO/NA

Page: 1 2