Neville White, head of RI Policy and Research, EdenTree looks at the production of palm oil, the risks for responsible investors, how it can be produced sustainably and how EdenTree tackles investing and exposure to the commodity.

Palm oil is a versatile vegetable oil extracted from the oil palm tree, which can be cultivated at tropical latitudes. It is the world’s most cultivated vegetable oil with a little over 76m tonnes produced globally in 2021/221, dwarfing soy which saw around 60m tonnes of cultivation. Demand has grown exponentially; in 1995, global production was just 15m tonnes. The vast majority of this expansion has occurred in Southeast Asia, which is the global centre for palm oil production. In 2021, it was estimated that as much as 19m hectares of land was under palm oil cultivation, accounting for both industrial and smallholder plantations2.

Palm oil is a very efficient crop with as much as 2.9m tonnes of palm oil able to be harvested from each hectare of land3. By comparison, rapeseed oil (canola) has typical yields of 0.8 tonnes/ hectare and sunflower oil yields of 0.7 tonnes/hectare. As a result, although palm oil accounts for the smallest percentage (6.6%) of all the cultivated land for oils and fats globally, it produces the largest percentage (38.7%) of total output. In addition to oil, the oil palm tree yields palm kernel and expeller (cake) which can be used in applications such as biofuels and animal feed.

Despite being native to Africa, oil palm trees were brought to Southeast Asia in the early twentieth century as an ornamental crop; Indonesia and Malaysia are now collectively responsible for around 85% of global production4. Smaller volumes are produced in Colombia, Thailand, Nigeria and Gabon.

The production Cycle

Palm oil trees begin producing fruits 2-3 years after planting. The red fruit bunches are delivered to local processing mills which produce kernel, fibre and oils. Applying steam, the oil is released which can then be onward shipped for refining into purified oil for use in a wide range of applications.

What is palm oil used for?

Palm oil is among the most versatile of vegetable oils; semi-solid at room temperature, around two thirds of the crop is used in food production and a further 25% in non-food and industrial applications such as soaps, detergents and cosmetics5. The remainder is used as a bio-fuel supplement.

Palm oil’s suitability as a frying fat means that it also accounts for around 35% of the world’s vegetable oil market and is a more affordable staple in poorer economies. This is in part because the environmental and social costs associated with production are not reflected in market prices; instead, they are considered “externalities”.

Palm oil is a widely used ingredient in personal care products, cosmetics, in confectionery snacks, ice cream, margarine and spreads, animal feed, pharmaceutical production, and industrial applications such as greases, lubricants and candles.

As a cooking oil, palm oil is a source of Vitamin E (natural tocotrienols) which helps lower LDL cholesterol, sometimes called ‘bad cholesterol’. It is also high in natural Vitamin A (carotenoids) that stimulate the immune system and is free from cholesterol and trans-fats. Unrefined palm oil is often used in traditional cuisine (for instance in West and Central Africa) and refined palm oil is used as an ingredient stabiliser.

As a fat the oil palm is around 50% saturated (less than higher oils and fats) and has been linked to protecting brain function, reducing heart disease and improving Vitamin A status.

What are the risks for responsible investors?

The stated environmental and social impacts of palm oil cultivation are wide-ranging and intrusive. The principal issues have stemmed from poor regulation and legal enforcement in the main production markets of Indonesia and Malaysia.

This has allowed major palm oil companies to expand the area of land under cultivation dramatically since the 1970s. Deforestation, peatland clearance and burning, land-grabbing, violation of indigenous people’s rights and biodiversity loss have gone hand-in- hand with this expansion.

As a plantation monoculture that does not encourage a rich biodiversity, countless species have been affected, with the precarious existence of the orangutan being familiar to many. This iconic species is native solely to Indonesia and Malaysia but has been subject to progressive loss of habitat pushing them back to just Borneo and Sumatra. Indonesia is home to the three orangutan species which are in long-term decline due to habitat loss. Whilst not exclusively down to palm oil cultivation, this has nevertheless been the main cause of their near critical extinction; one study stated that between 1999 and 2015 around 150,000 orangutans were lost6. Orangutans are not the only species at risk: according to the IUCN, 193 critically endangered, endangered and vulnerable species have palm oil production as one of their main threats.7

The impact of deforestation

Palm oil cultivation takes place across a narrow equatorial band in countries that are broadly stable, but which lack critical systems to prevent aggressive deforestation. As a versatile, easy to grow vegetable oil, the demand for palm is only likely to grow. Satellite imagery reveals the growing reality of forest loss due to palm oil production. Growth in demand, limited land resource and weak legal oversight leads to ‘land grab’ and forest clearance to provide additional hectarage for palm. Efforts made by governments, NGOs and businesses to reinforce the need for sustainable palm oil is slowing the rate of forest loss – some companies such as Nestlé, Unilever and M&S are close to securing 100% of supply from certified sources; nevertheless, the destruction of native species, biodiversity loss, soil erosion and pollution are some of the chief implications of exponential palm oil cultivation.

Towards sustainable palm oil

The reputational risks from deforestation and the consequent ecological impact – alongside human rights abuses such as land-grabbing, child and forced/bonded labour – resulted in attempts by business, NGOs and governments to work towards making palm oil more sustainable by certifying the supply chain.

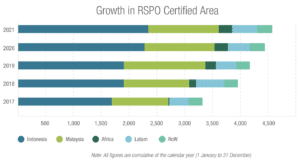

Since 2004 this has been manifested through the Roundtable on Sustainable Palm Oil (RSPO), an NGO and certifying body. Since its inception, the RSPO has gradually increased the area covered by its certification scheme. The RSPO currently certifies 4.8m hectares of palm oil cultivation, representing an annual certified production volume of 14.6m tonnes8. The RSPO’s 2022 Impact Report also highlighted that an area of more than 301,000 hectares of High Conservation Value (HCV) land has been set aside and managed by RSPO members, distributed worldwide across 17 countries9. An estimated 19% of all palm oil produced globally is now certified under the RSPO standard10.

Despite this progress and growing its membership to over 5,000 businesses and stakeholders, the RSPO has been criticised for failing to improve the industry’s overall sustainability credentials adequately. In particular, the RSPO has been accused of insufficiently robust auditing of plantations and their impacts, as well as human and labour rights violations by some of its members. The RSPO itself, whilst challenging some of these criticisms, has acknowledged that gaps still remain in its understanding of how certification translates into real-world impacts.

The unpalatable truth is that because oil palm trees can only be cultivated in tropical regions, there is a danger that expansion of the industry will be contingent on deforestation, not least where government sets the economic tone for aggressive land clearance and palm afforestation or where the rule of law is weak to prevent ecological devastation during its cultivation.

Yet this is not inevitable. In 2018, National Geographic investigated the fledgling palm oil industry of Gabon, in West Africa, documenting the efforts being made by major palm oil companies, the Gabonese government, NGOs, and other stakeholders to develop the industry responsibly, with environmental and social considerations in focus. This includes setting aside large HCV areas of forest, and only developing plantations where impacts are most limited, as part of a national land-use plan. Such a plan seeks to balance the economic needs of the country – which is in fact relatively wealthy by sub-Saharan African standards – with those of local communities and ecosystems. In other words, Gabon is seeking a planned, sustainable palm oil industry, rather than one bent on growth at any cost.

What does EdenTree look for?

Our screened Funds and mandates have no direct exposure to palm oil cultivation. Instead, our exposure to the commodity is indirect, chiefly through bank financing and food producers and retailers. Where companies have palm oil in their supply chains or are financing palm oil companies in Southeast Asia and elsewhere, our minimum expectations are for “No Deforestation, No Peat, No Exploitation” policies, and evidence that these are strictly adhered to. Commitments to source, wherever possible, certified-sustainable palm oil (as certified by the RSPO) are also essential.

Help in this regard can also come from tools such as SPOTT, (the Sustainable Palm Oil Transparency Toolkit) pioneered by the Zoological Society of London (ZSL), which provides interactive company scorecards across seven indicators including environmental management, zero burning, GHG emissions and traceability. In addition, we also consider any human rights violations or evidence of poor environmental policies and practices when (i) screening and reviewing companies with exposure to palm oil; and (ii) engaging with companies with exposure to the sector.

Within the banking sector we look for comprehensive policy disclosure on palm oil financing (where appropriate) as well as clear commitments not to deforest. The quality of bank policies are assessed by the NGO Banktrack, which we use to help judge whether these are generally robust enough to mitigate poor outcomes.

An industry snapshot

This Expert Brief has set out the versatility of the oil palm as an all-purpose ingredient and lubricant, but also the impact its cultivation can exert on deforestation and biodiversity loss. The CDP, via its forest disclosure survey publishes an annual snapshot of industry’s efforts to decouple deforestation from their supply chains. 2021 saw 233 companies respond to the survey request, of which 167 companies sourced palm oil. The CDP found that 86% of companies had developed policy, but only 22% had adopted specific ‘no-deforestation clauses’; 87% of companies had traceability processes in place, but just 25% felt they could scale this to cover 90% of their supply needs11. Overall the report concluded good intentions but with some way to go to make these intentions concrete. That has informed our current approach of engagement, coupled with public policy support where possible.

Conclusion

Although a near universal ingredient in consumer products and food manufacture, palm oil presents responsible investors such as EdenTree with a range of environmental and social risks. But, as the IUCN’s 2018 report noted, it seems apparent that palm oil is “here to stay”.

The war in Ukraine (as we write) has seriously depleted global supplies of alternatives such as sunflower oil where Ukraine is responsible for 31% of the global crop, forcing upward pressure on all vegetable oil prices, and, at least for the foreseeable future, increasing demand for palm oil. For instance, oil palm producer Presco logged its highest turnover since 2011 following the disruption to global supply chains.

Because of the risks we have articulated, investing in companies with exposure to palm oil – however indirectly – must be undertaken with great care and attention.

Our main approach remains not to invest in palm oil cultivation via plantation companies such as AAK, Sime-Darby, Wilmar International, Bunge, Cargill and Golden Agri-Resources. We accept, pragmatically, exposure to palm oil as an ingredient, with the proviso that companies should source RSPO certified palm or seek alternatives. Our main exposure would therefore be through food producers. Producer manufacturers of household, beauty, cosmetic and astringents are likely to fall outside of our animal testing policy, and so this area of exposure will also be extremely limited.

This article and others can be found on the Eden Tree website

SOURCES

1. www.statista.com

2. www.ourworldindata.org/palm-oil

3. ibid.

4. www.wwf.org.uk

5. ibid.

6. www.nationalgeographic.com

7. https://www.iucn.org/resources/issues-brief/palm-oil-and-biodiversity

8. www.rspo.org

9. ibid.

10. ibid.

11. Measuring Progress Towards a Sustainable Palm Oil Supply Chain: A Company’s Journey (cdp.net)

[Main image: simone-millward-nKGio_6E_4k-unsplash]