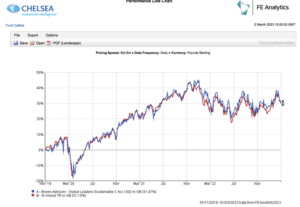

Continuing her regular column for Professional Paraplanner, Juliet Schooling Latter, research director, FundCalibre, analyses the three-year track record of the Brown Advisory Global Leaders Sustainable fund.

In their simplest form, global equities are a one-stop shop for investors who don’t want to have to worry about deciding geographical allocations in their portfolios. With more than 41,000 stocks listed on stock exchanges worldwide*, the opportunity is both vast and complicated – making it the ideal place for an active manager to flourish.

In a confusing world of rising interest rates and the growing threat of recession, dispersion in returns is likely to grow from here. Many true active managers will not pay any attention to the benchmark and will simply invest where they find the best opportunities globally, regardless of where a company is listed. Their success will be driven purely be their own decision making.

By investing in 30-40 companies across the globe, this month’s fund is a perfect example of active decision making, with the managers looking for companies delivering exceptional outcomes for their clients, with compounding returns over many years.

The Brown Advisory Global Leaders Sustainable fund launched in November 2019 under the management of Mick Dillon and Bertie Thomson.

It is an extension to the existing Global Leaders franchise (launched back in 2015)- the difference being that although the sustainable philosophy and research framework is applied across both funds – targeting ESG risks and sustainable opportunities – this version offers additional back end screens designed to avoid certain business controversies.

The sustainable vehicle looks to exclude companies that defy United Global Compact Principles; directly manufactured controversial weapons; animal testing for non-medical purposes; and companies whose primary business activities are directly tied to various activities involving the use of fossil fuels. In addition to this, companies with more than 5 per cent of their revenue derived from the manufacture of conventional weapons; alcohol and tobacco products; adult entertainment, gambling and nuclear power-related activities are excluded**.

The result is very few changes between the portfolios with French aircraft designer Safran the only difference at present due to its involvement in defence contracts with the French Government.

Mick Dillon joined Brown Advisory in 2014, launching Global Leaders a year later. Prior to this, he was co-head of Asian equities at HSBC in Hong Kong. He is supported by Bertie Thomson, who became co-manager in 2016.

This is a bottom-up fund which focuses on its own internal research and largely ignores wider macro-economic factors. The aim of the fund is to invest in market-leading businesses with ‘superior customer outcomes’. The managers call these businesses ‘global leaders’. These companies should be able to solve a problem that no one else can. This should then enable them to generate consistently high and sustainable returns on invested capital. The team’s investment philosophy is driven by academic research which shows that companies that are global leaders tend to stay global leaders.

The managers begin by screening companies for high returns on capital, free cash-flow, valuation and sales growth. This reduces their investable universe from around 4,500 to 300 companies. Ideas come from analysts, on-site company visits, insights from experience, and the Brown Advisory network of venture capital, clients, directors and private equity. Companies must be over $2 billion in market cap to be considered.

Firstly, companies need to offer an exceptional customer outcome. Typically, these business will have a dominant market position and multiple competitive advantages. Secondly, companies must have a 20 per cent return on invested capital or a pathway to it within five years. Thirdly, company management must demonstrate that is has allocated capital skilfully and ethically in the past. Finally, the valuation must be appealing.

Once they have passed all four stages, the research team will undertake full due diligence on the stock. The managers will also interview the company’s customers to really understand if the product or service it is selling is indispensable. ESG analysis, as expected, is also undertaken, while the managers also use a third party consultant to analyse their decision-making for behavioural errors.

With such an uncertain outlook, it is comforting to know that Mr. Dillon believes the quality of investments within the fund is at its highest since launch. He says: “The team has relentlessly focused on analysing companies on our ready-to-buy list—which serves as a valuable source of ideas—while also significantly expanding our pipeline.

“Last year has once again reminded us that volatility is not risk but opportunity—for us we define risk as the permanent destruction of our clients’ capital which primarily comes from competitive disruption or overpaying for great businesses.”

This fund has a clear philosophy. We particularly like the relentless focus on businesses which deliver ‘superior customer outcomes’ – a bi-product of the emphasis on high quality fundamental stock research. The managers’ willingness to analyse their own performance and mistakes, and their constant desire to improve, is a further positive. The result is a strong core global product for those wanting an additional ESG lens.

*Source: Fidelity.com

**Source: Brown Advisory – Global Leaders Sustainable Fund presentation

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.

[Main image: nejc-soklic-yZ6MnFo5hX0-unsplash]