The 2024 Finance Bill introduces a range of changes to the pensions regime, not least the abolition of the LTA. Daniel Bosiacki, technical consultant at AJ Bell, considers the changes and uses a case study for those who have already used up some lifetime allowance before 6 April 2024.

When considering upcoming big dates for our diaries, we need to look at the self-assessment filing deadline, the Spring Budget (6 March) and from April 2024, the new pension benefits regime.

A brief overview of the headline concepts the government plans to introduce from 6 April 2024 is in order. It’s worth caveating there may be potential for some minor adjustments before it receives Royal assent. That aside, we can expect:

- The lifetime allowance will be removed from legislation

- Three new allowances will replace it:

- A lump sum allowance (LSA), designed to replace current limits on tax-free cash payable during the member’s lifetime, fixed at £268,275

- A lump sum and death benefit allowance (LSDBA), limiting the combined amount of tax-free lump sums paid in the member’s lifetime and on their death, to be set at £1,073,100

- An overseas transfer allowance (OTA), testing any transfers to a QROPS

- Transitional provisions will reduce these allowances based on the amount of lifetime allowance the member had used prior to 6 April 2024 – this will prevent tax-free allowances from being reset

- All benefit crystallisation events (BCEs) will be removed and we will instead have relevant benefit crystallisation events (RBCEs) when lump sums are paid

- Those with lifetime allowance protection will continue to benefit from it under the new rules, in the form of increases to the new allowances

- Importantly, using funds to provide a form of pension income will not be tested against any limits

Whilst the new rules mark a fundamental shift from current legislation, there remains some correlation with existing figures, percentages, and methods. A bit reminiscent of “meet the new boss same as the old boss” if you like. For example, tax-free cash is capped at the lower of one third of the amount used to provide an income and the available LSA, which in practice is the same as the 25% of the fund value up to the available LTA. That said, there are some new points to consider, and they may influence your thinking or the solutions you provide to your client(s).

One such example revolves around the LSA and LSDBA calculations for those who have already used up some lifetime allowance before 6 April 2024. The reduction to both allowances will be calculated upon the first RBCE post 6 April 2024.

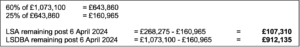

Let’s consider Fred. If Fred had used all his LTA, his LSA and LSDBA would be £nil. However, Fred has only used 60% and has confirmed that he hasn’t received a serious ill-health lump sum, so he will have the following allowances remaining under the new rules:

Fred can take up to £107,310 as a tax-free lump sum provided, he has sufficient funds to provide the required associated income.

If he dies before age 75 and his beneficiaries choose the lump sum option, they can receive up to £912,135 tax free less than the amount of any tax-free cash Fred has taken after 6 April 2024. However, any funds crystallised before 6 April 2024 are not included in the amount that is tested. Importantly, any death benefits taken as income will not be tested and will not be subject to income tax.

On death after age 75 there are no tests but benefits are subject to income tax for the recipient regardless of whether taken as a lump sum or income.

However, there may be a way clients can boost their allowances.

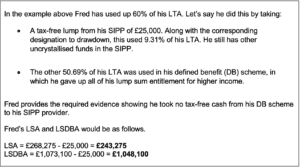

If a client had given up a tax-free lump sum in a defined benefit scheme in exchange for a larger pension income, they could effectively get back that lump sum entitlement, which they could make use of under another scheme, such as a SIPP. This could be useful to some clients.

To do so, they would need to provide evidence to a current pension provider of lump sums taken under all schemes. Their LTA position would then be ignored, and their LSA and LSDBA would be calculated by deducting previous lump sums from it, which the current provider would confirm on a ‘tax-free cash amount certificate’.

Fred now has significantly more of his allowances left, so for clients in this situation it’ll be worth checking the details and crunching the numbers.

All that remains is to watch this space for the final regulations which are expected imminently ahead of an April 2024 start. A new world of pensions benefits is upon us.